I first did this research in March 2024.

Its goal was simple – to study in detail what is happening in the SEO software market, namely in terms of customer acquisition strategies and product development.

I needed it to build a strategy for Sitechecker.

Six months later, I saw that the trends I had noticed then had developed even further and some of my predictions had come true.

Research methodology

1. I collected data on 70 sites that represent SEO tools. These are the sites that somehow got on my radar, usually in the process of competitive intelligence.

2. I understand that there are dozens of other interesting tool that are not on the list.

The goal of this study:

- not to collect the most complete list of the SEO tools;

- not to determine the winners in some nomination;

but to study what strategies in marketing, pricing and product management are used by SEO software companies.

As a rule, these strategies concern only market leaders, since small companies are often invisible and have few resources for experiments.

3. There are 3 main data sources I used to collect metrics:

The raw data by annual revenue, amount of employees, search traffic, etc can be accessed in this Google Sheet.

But metrics are just a starting point to see what type and size of companies are on the market.

The most interesting things in marketing strategies can only be found by observing the dynamics of website changes. Below are just such observations. This is what first caught my eye.

Acquisitions for the last 5 years

In March 2024, I predicted that the industry would see even more acquisitions by big players.

After that, Semrush bought 3 more companies during the year.

More new tools to create and optimize content

The rise of AI tools like ChatGPT, Claude, Perplexity, etc., leads to 2 things:

- opportunities to create content much cheaper have appeared;

- only a small part of people know how to use AI Caption Generator themselves to create content of good enough quality with high speed.

This creates a huge demand for simplifying the process of generating and optimizing content.

Here some of the tools that appeared recently:

- Positional (backed by Y combinator);

- Contentedge (backed by Y combinator);

- Demandwell;

- Writerzen.

Most of these tools use the same technology, and are not much different from each other.

As for me, leaders are distinguished by 3 things:

- constant innovations in prompts;

- better user experience;

- hacking the distribution and user education.

Why did everyone rush to create these tools?

- because there is obviously good retention (content is needed by everyone and regularly);

- because the main innovations for success are needed in marketing, not technology, which reduces the cost of entry.

Our team has been trying to develop a similar tool (Copywritely) for a long time, but eventually decided to narrow our focus to developing only one platform.

SEO influencers create their own tools

Influencers create their own SEO tools or join as partners to existing tools. Primarily content optimization tools 🙂

Here are some of the examples:

- Matt Diggity invested in SurferSEO;

- Nathan Gotch launched Rankability;

- Charles Floate launched Topical Map AI;

- Jake Ward launched Byword.

Competition is growing, the SEO market is becoming mature, and customer needs are well understood.

In this situation, distribution is becoming the bottleneck for most companies.

Influencers see opportunities in this. Launching your own tool is a riskier project than being an ambassador, but the opportunities are also much greater.

Trends in user acquisition (organic search traffic)

1. AI and content tools with low conversion rates but high search volume

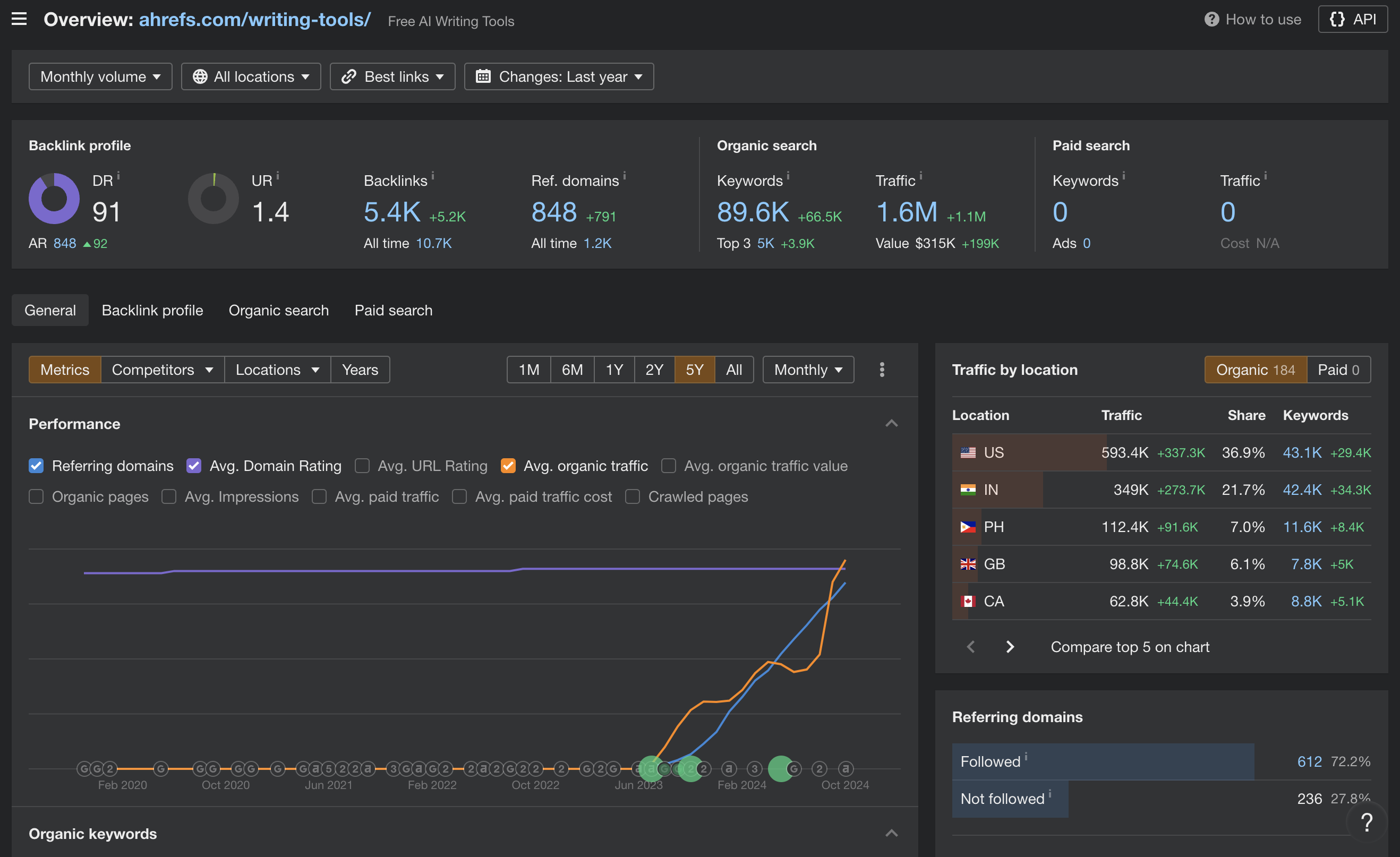

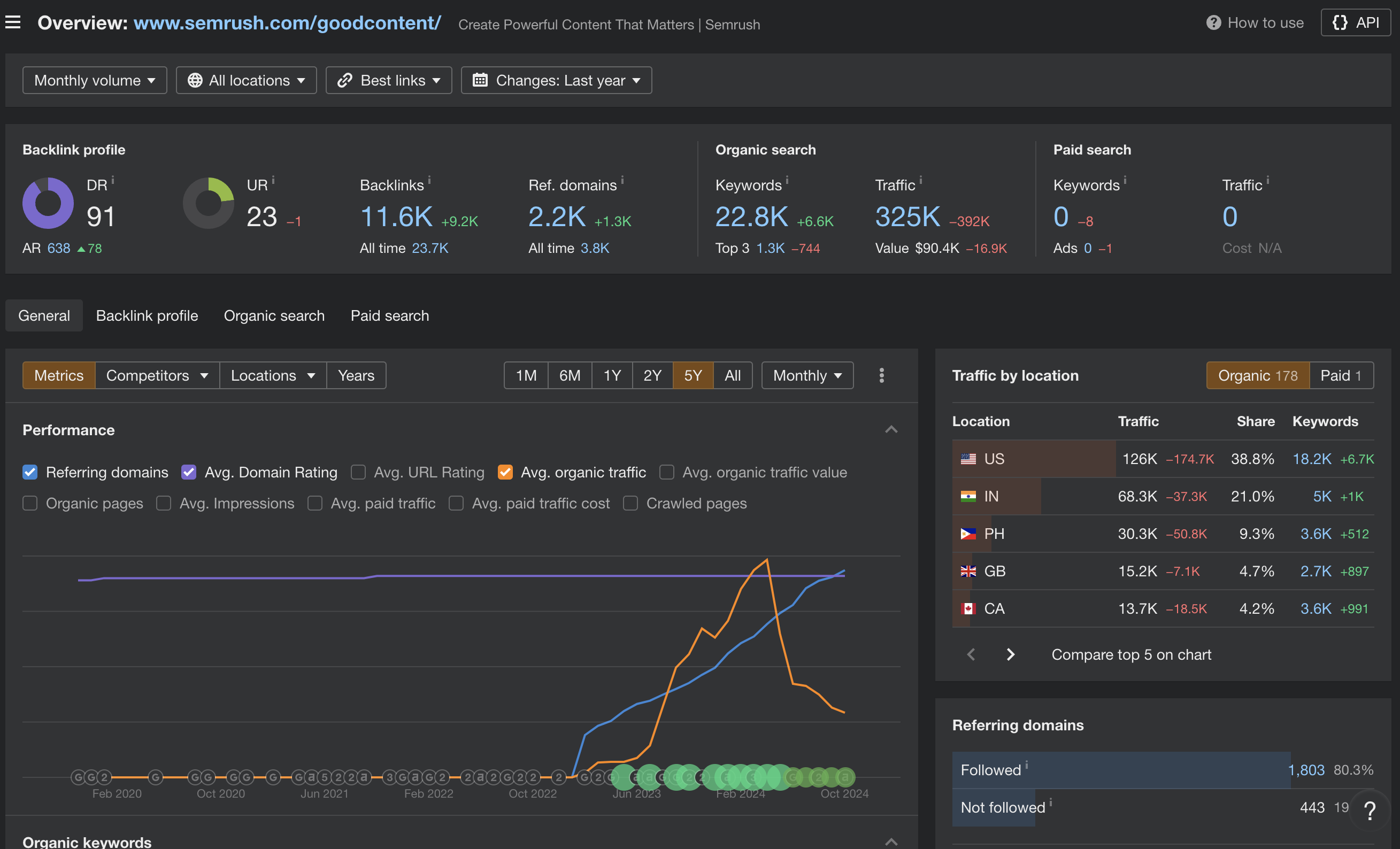

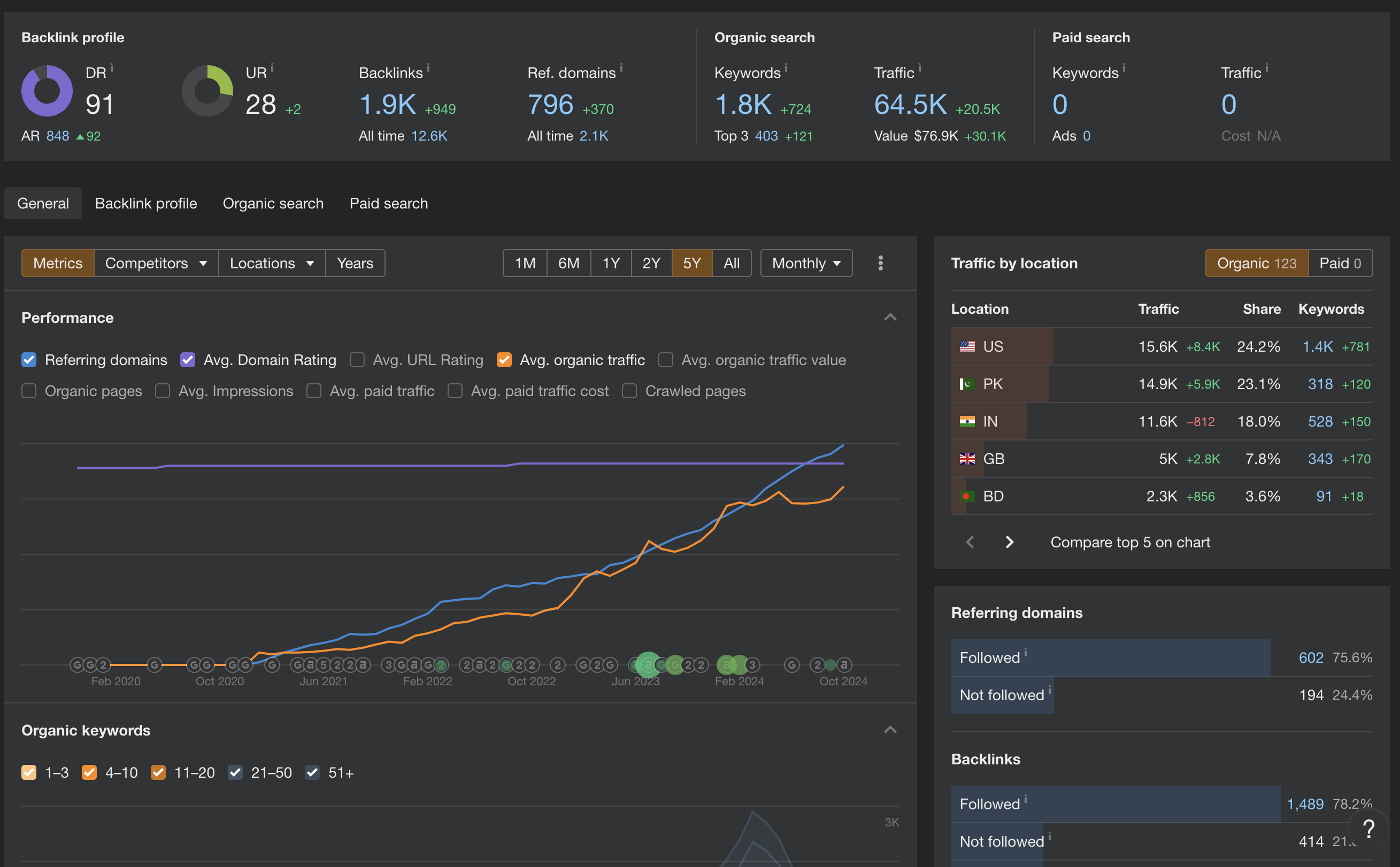

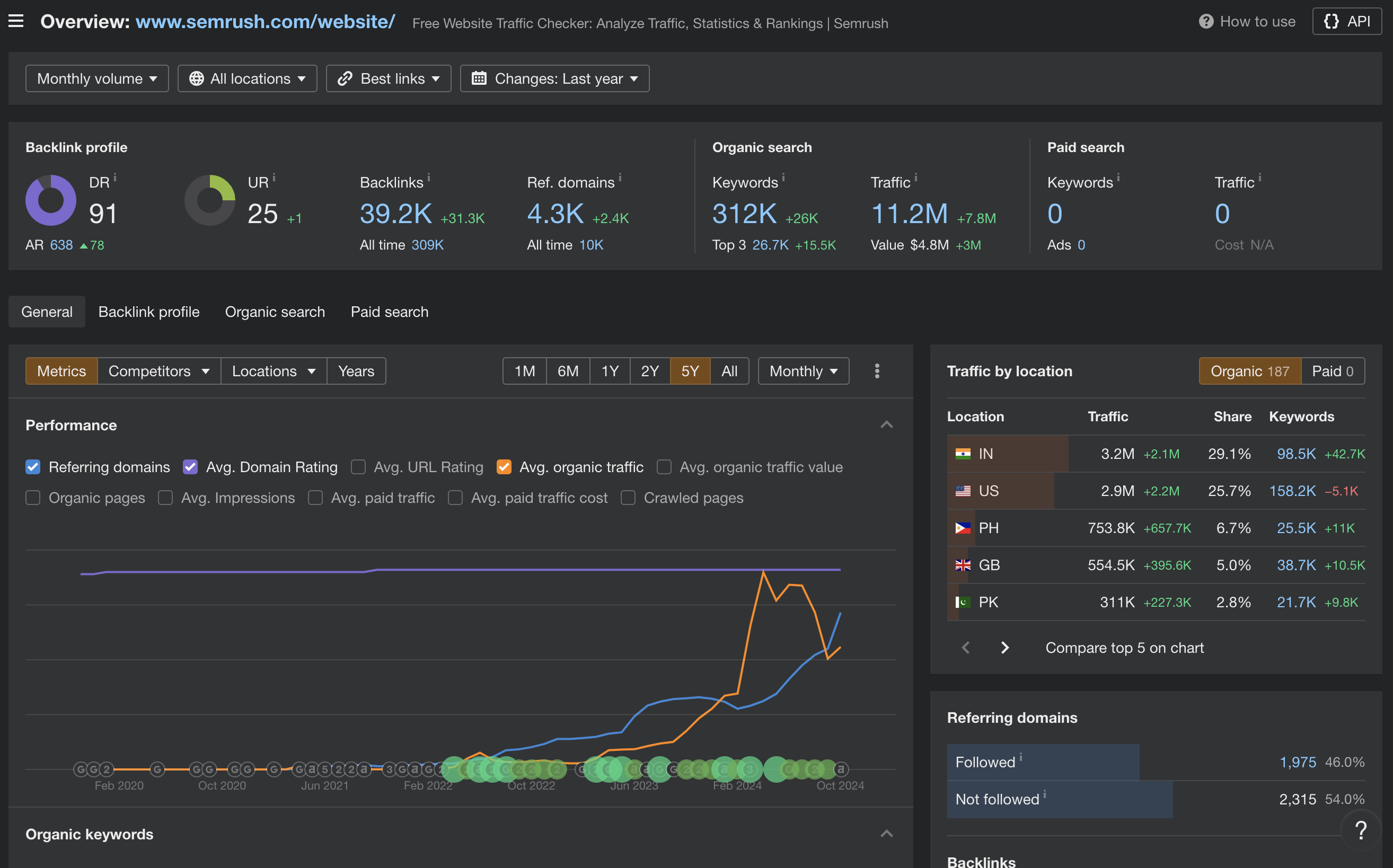

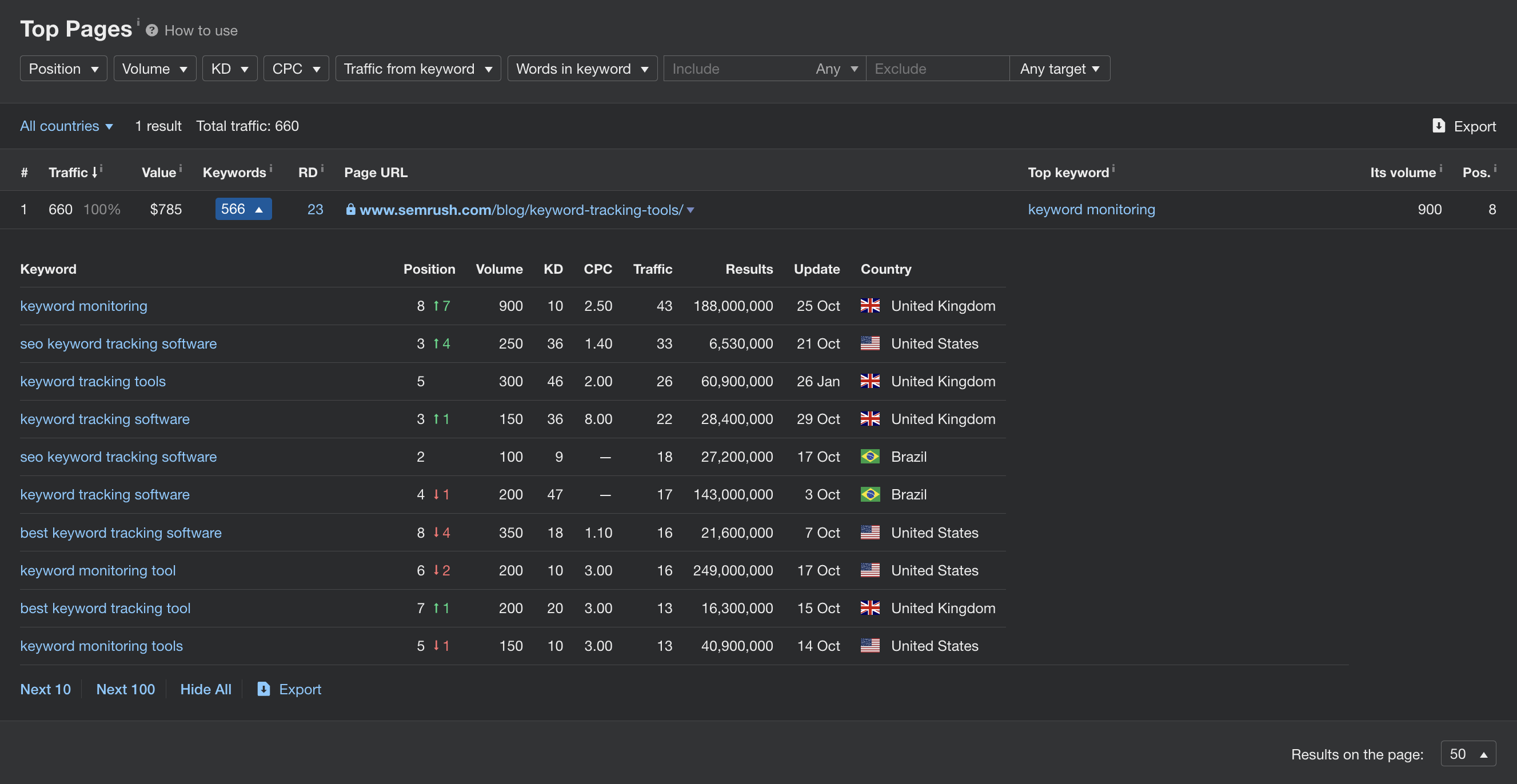

Semrush and Ahrefs both used this method to multiply their traffic.

This traffic probably has a very low conversion rate, but the costs of creating these pages are also small.

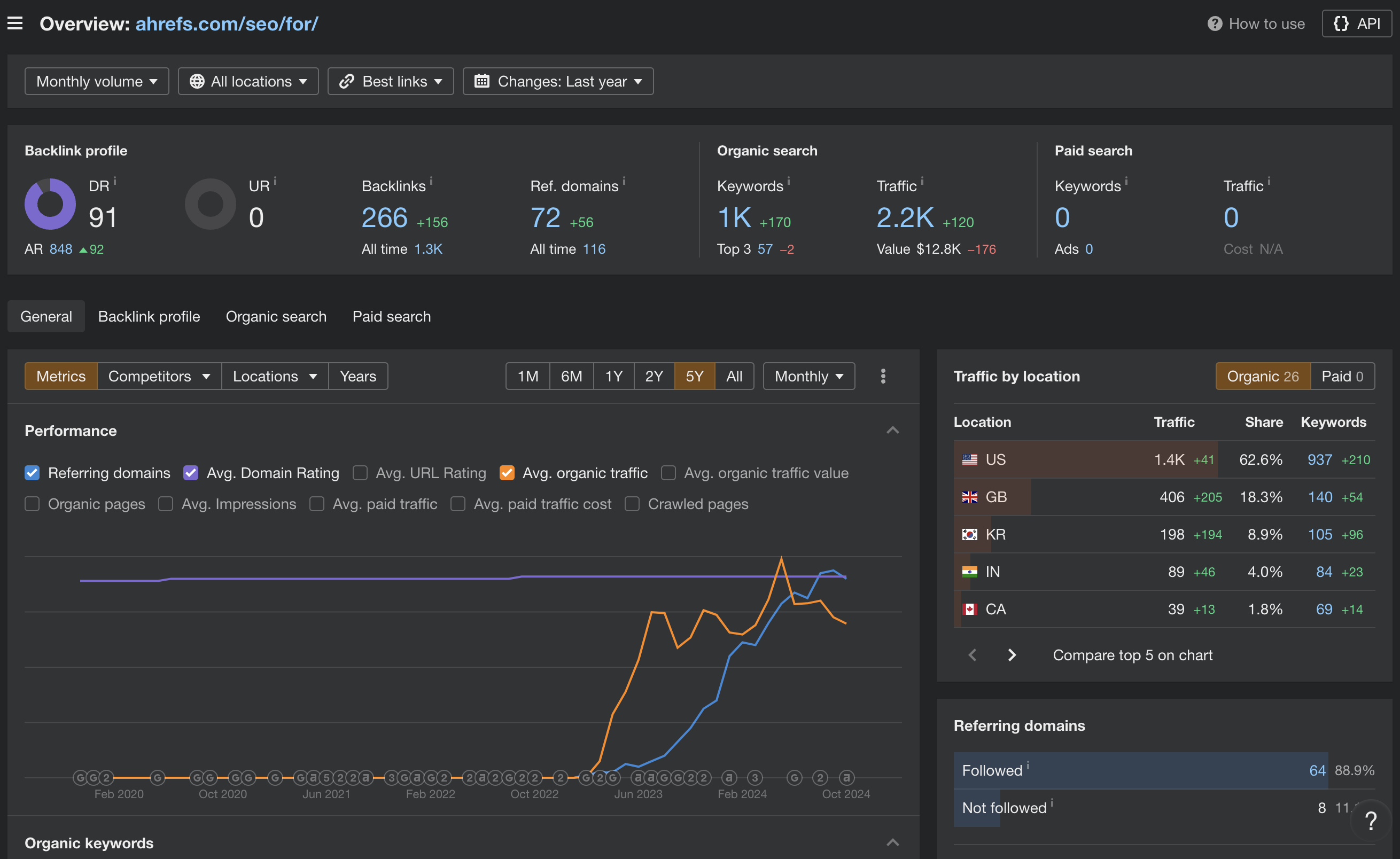

Based on the screenshots, it looks like this category of pages is more successful in Ahrefs.

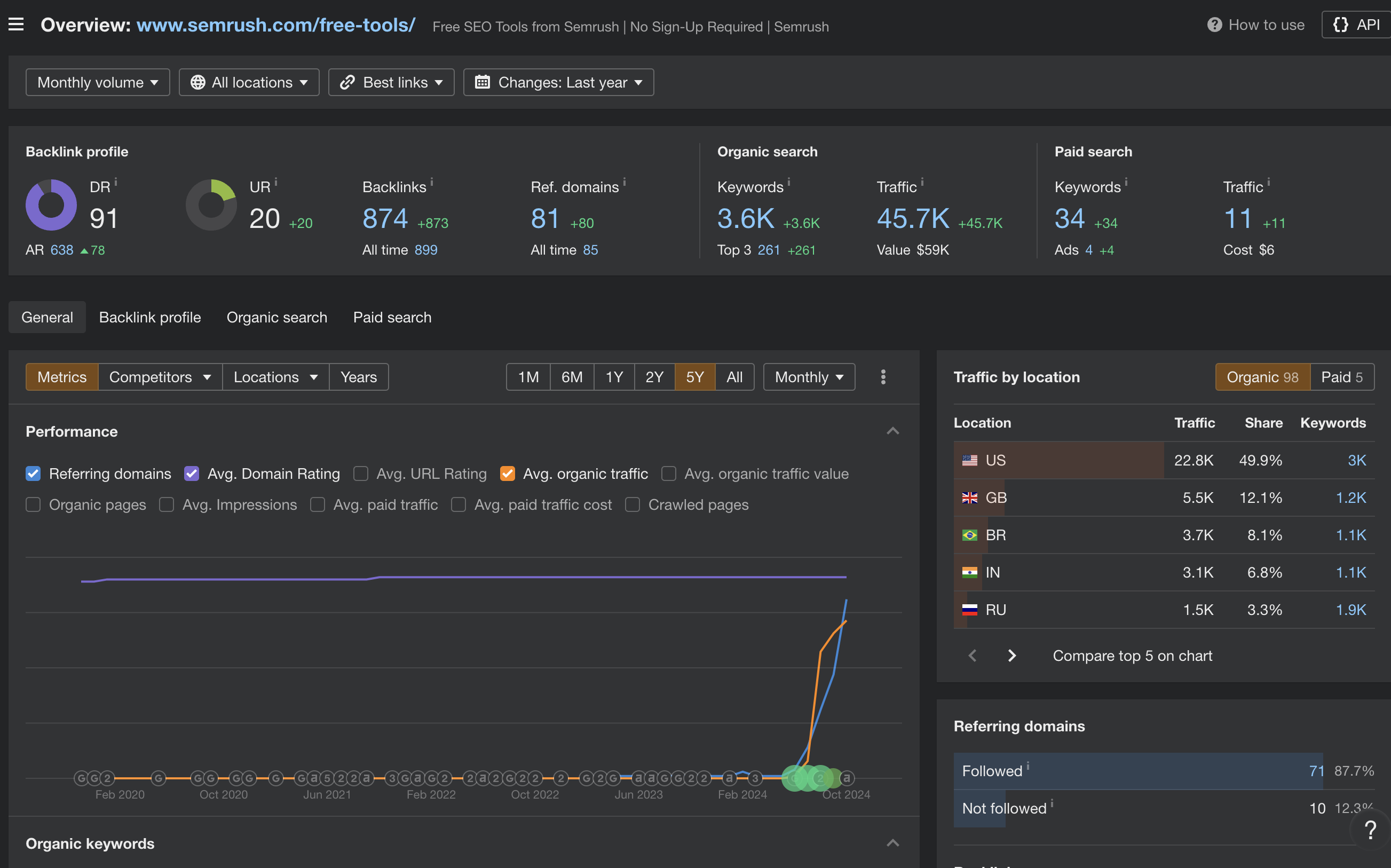

2. Free SEO tools

In my opinion, this tactic is becoming a mandatory standard for most SEO players.

These type of pages have both good search demand and good conversion potential (if the funnel is done correctly).

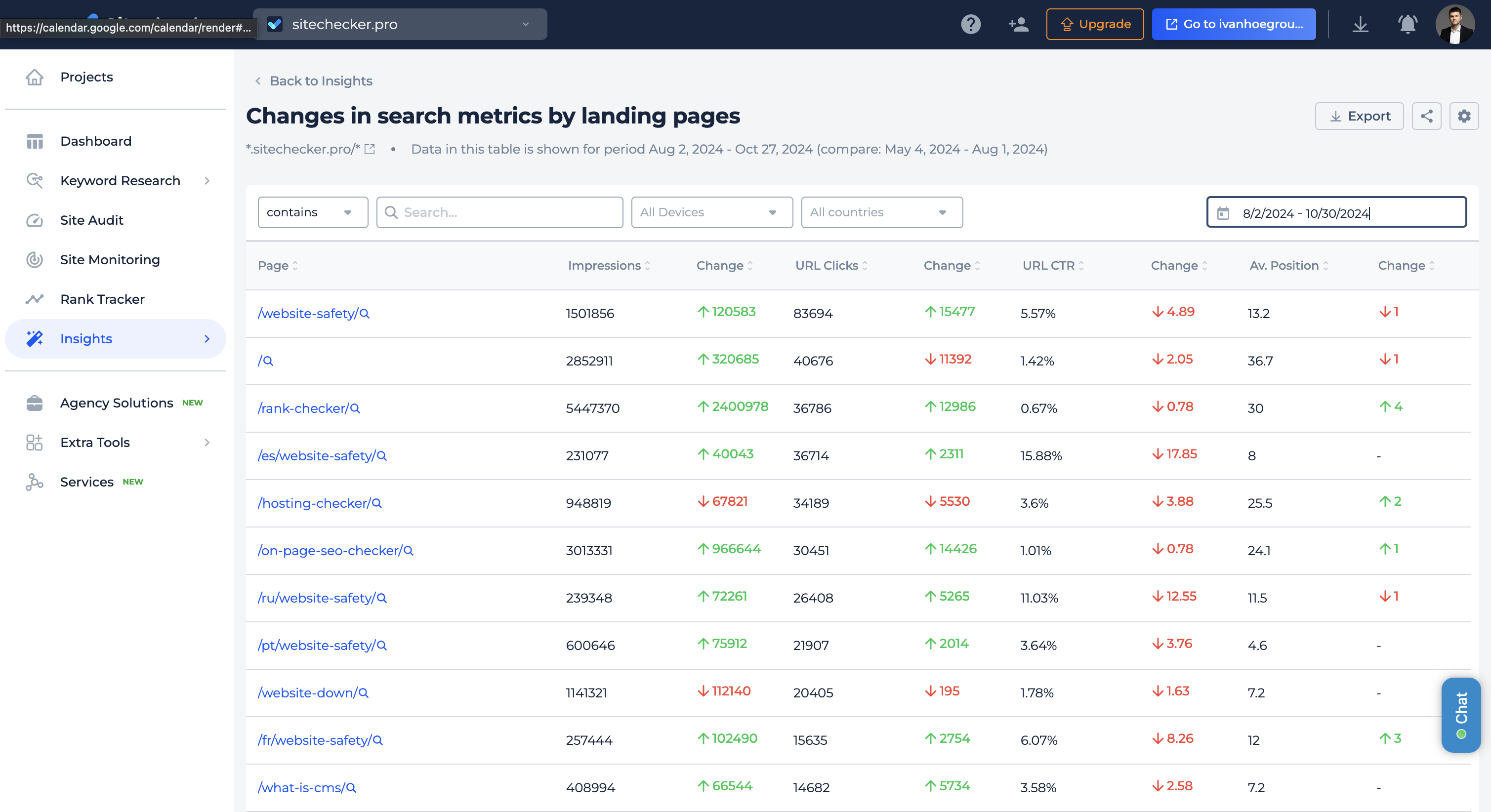

We were not the first to start using this method, but our team has brought this tactic to perfection.

Now these pages bring us about 60-70% of all traffic.

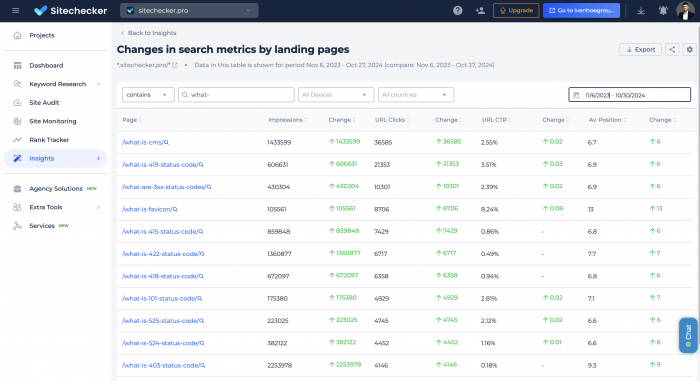

Unfortunately, we created a separate page for free SEO tools too late. All such tools do not have their own subfolder and because of this, this segment is difficult to analyze, but if you look at the best pages by clicks, you can see that all of them, except for the main one, are free tools.

Ahrefs works quite successfully in this category for years too.

Semrush only decided to launch this category this summer.

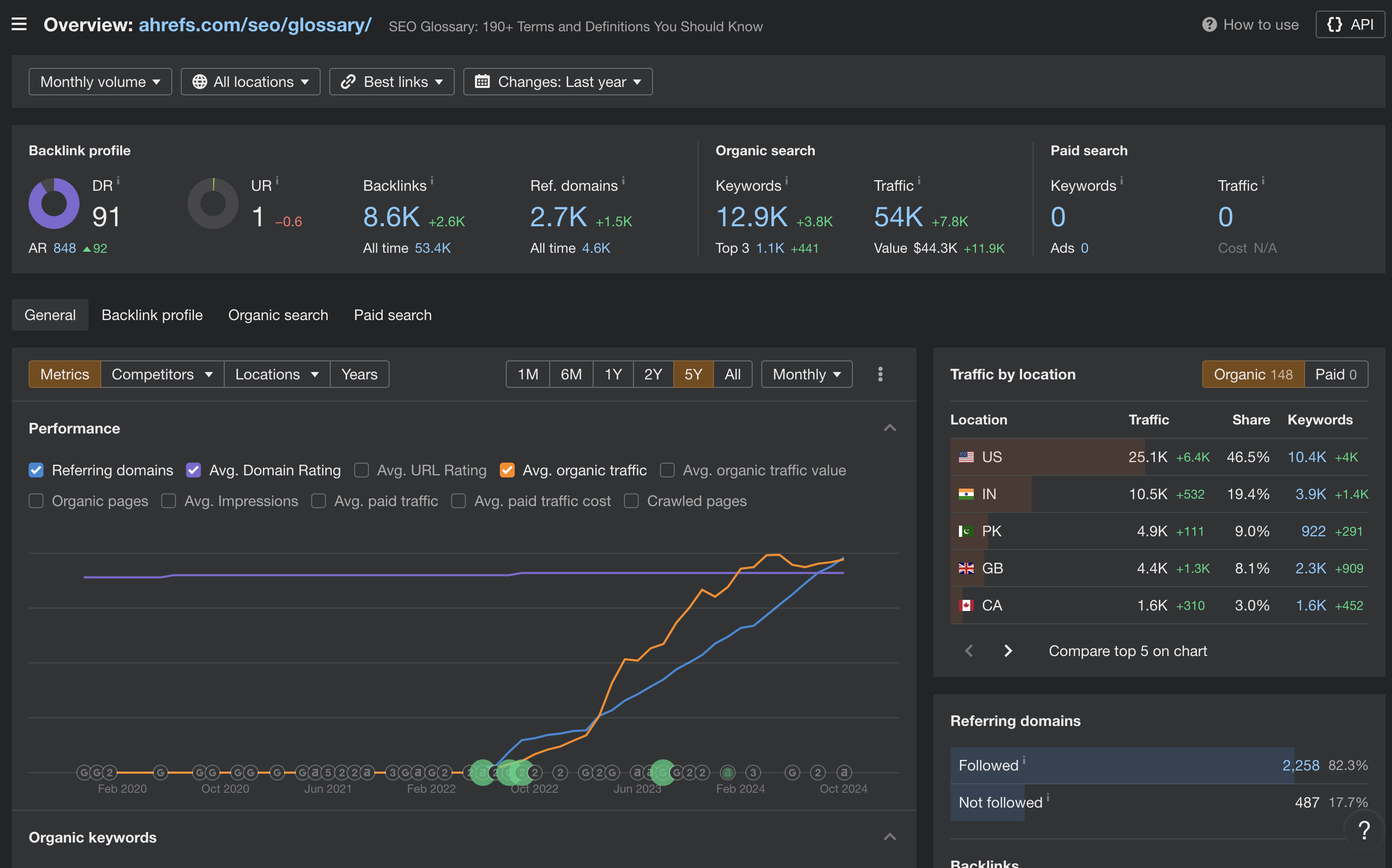

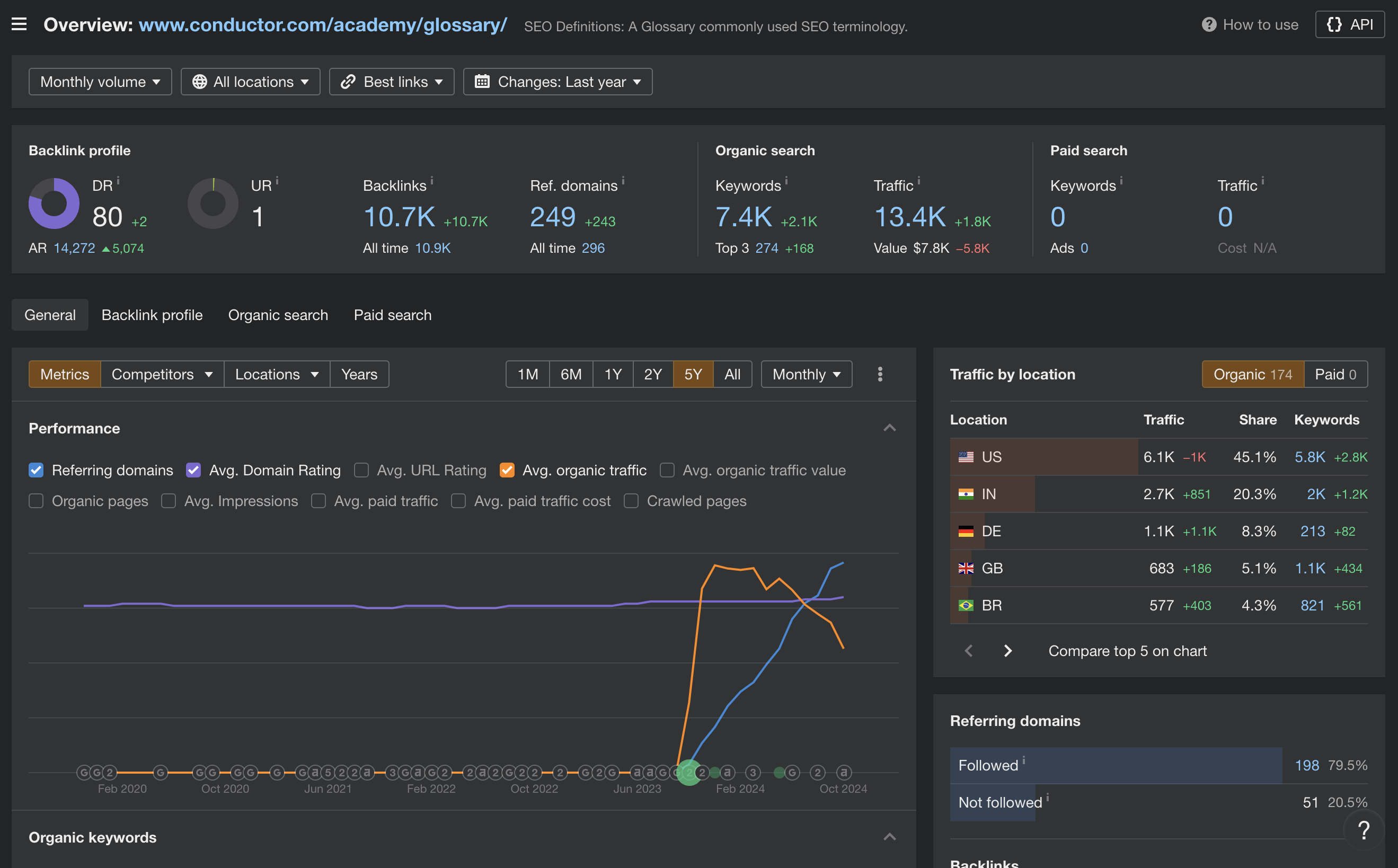

3. Glossary pages

It is obvious that this traffic also has a very low conversion rate.

But each such page can attract backlinks. And then send traffic from Google AI Overview and AI chats, which will link to information sources.

Dynamics of this category on Ahrefs‘ website.

Dynamics of this this on Conductor‘s website.

We also have pages of this type on different topics, but the cluster associated with status codes brings the most traffic.

It seems that Google understands that this is our main expertise – insuring sites from unavailability and problems with visibility in search 🙂

4. Pages to target keywords “SEO {for a specific industry}”

This is a small category, but according to my forecasts it has high conversion potential in the small business sector.

Ahrefs created a separate template for such pages. Good move!

- https://ahrefs.com/seo/for/realtors

- https://ahrefs.com/seo/for/beauty-salons

- https://ahrefs.com/seo/for/dentists

We tried to create such content, but we were not able to put it in the top 10 with little effort.

Semrush also creates similar content, but does not highlight it as a separate category.

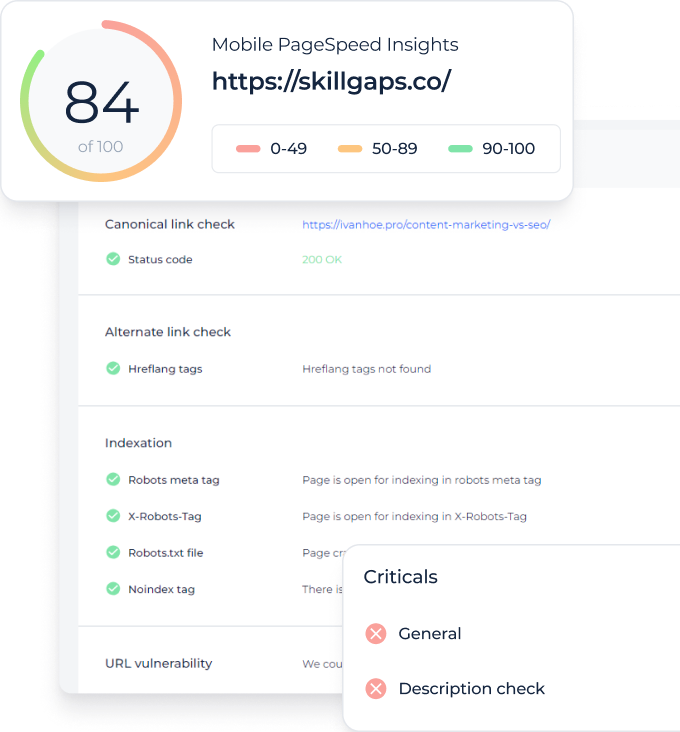

5. Indexing pages with reports by websites

Here are examples of such pages on websites:

- https://semrush.com/website/statista.com/overview/;

- https://ahrefs.com/websites/sky.it;

- https://freetools.seobility.net/en/seocheck/www.irisfmg.fr (they were implemented on the main domain name but then redirected to separate subdomain);

- https://www.seoptimer.com/www.wheaton.edu;

- https://www.accuranker.com/serp-analysis/us/nytimes.com/ (it seems that they abandoned this strategy and deleted these pages);

- https://index.woorank.com/en/reviews;

- https://diib.com/featuredmembers/ (it’s not reports, just pages with backlinks to customers :)).

This is one of the most interesting tactics.

We thought for a long time whether we should use it for Sitechecker too. We came to the decision that we should not.

Indexing report pages containing some unique data from your service can bring you huge traffic!

But there is a problem: most of this traffic is branded queries from users of a specific website, which in 99% of cases are not your target audience.

This tactic creates big risks:

- you reduce the thematic relevance of your website;

- you spend your crawling budget on low-value pages;

- you spend resources on updating and maintaining this cluster of pages.

As we can see, Semrush has successfully implemented this tactic so far.

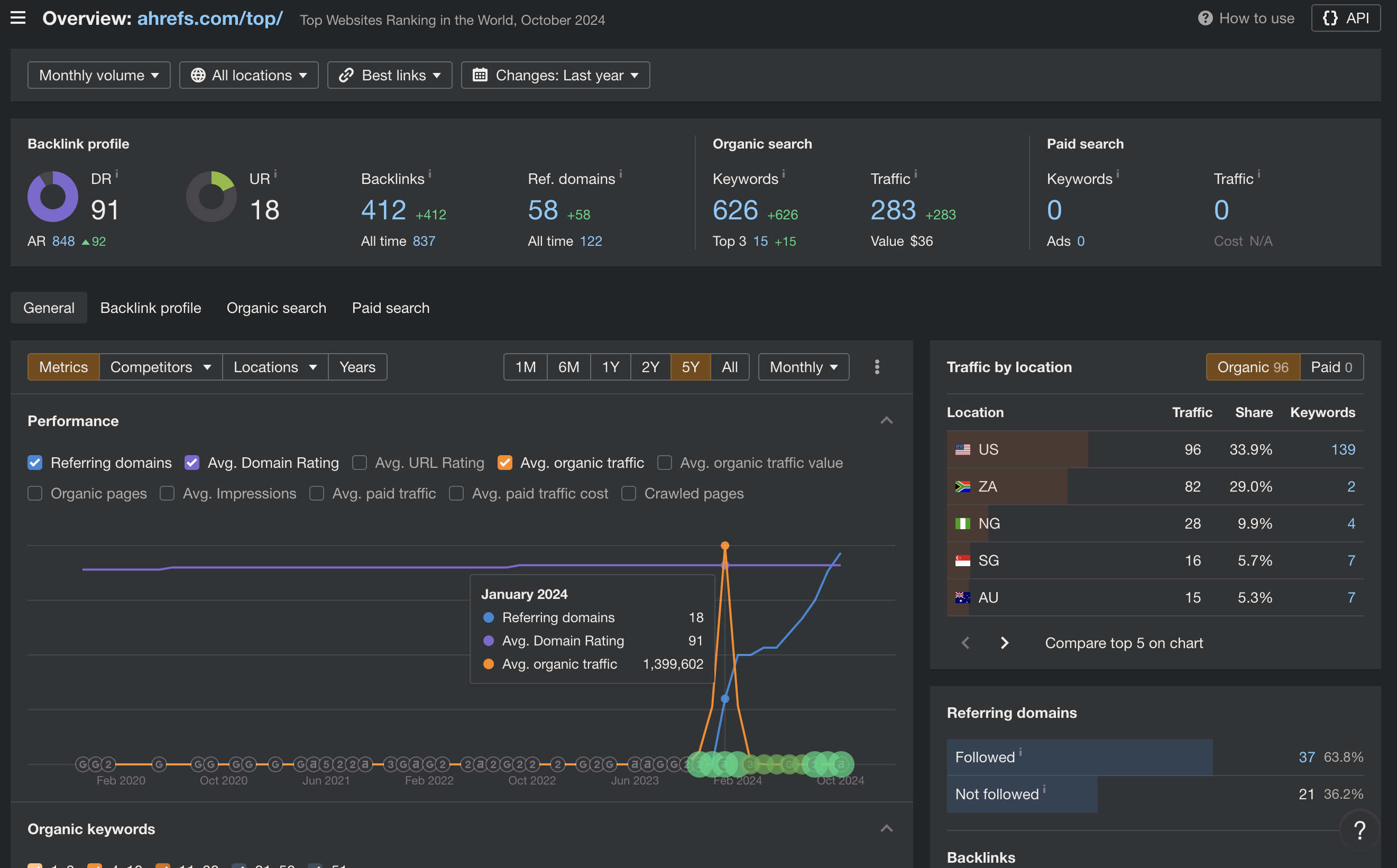

Ahrefs tried to launch it at the beginning of the year, but some technical error ruined everything. I shared my observation in this tweet.

After this, it is clear that Ahrefs decided to try to do this on a smaller scale and in a new subfolder (the right decision).

6. Agencies directories

Сreating a directory of agencies is a great idea, which we also thought about. But we abandoned it, since its high-quality implementation requires a lot of resources.

There are a lot of ads in the top of Google and such giants as Google Maps, Clutch, Semrush.

This traffic is so valuable for two reasons:

- Those who are looking for an SEO agency may decide to buy a tool and work on own SEO without the agency.

- After receiving traffic, you can sell agencies access to leads for an additional price.

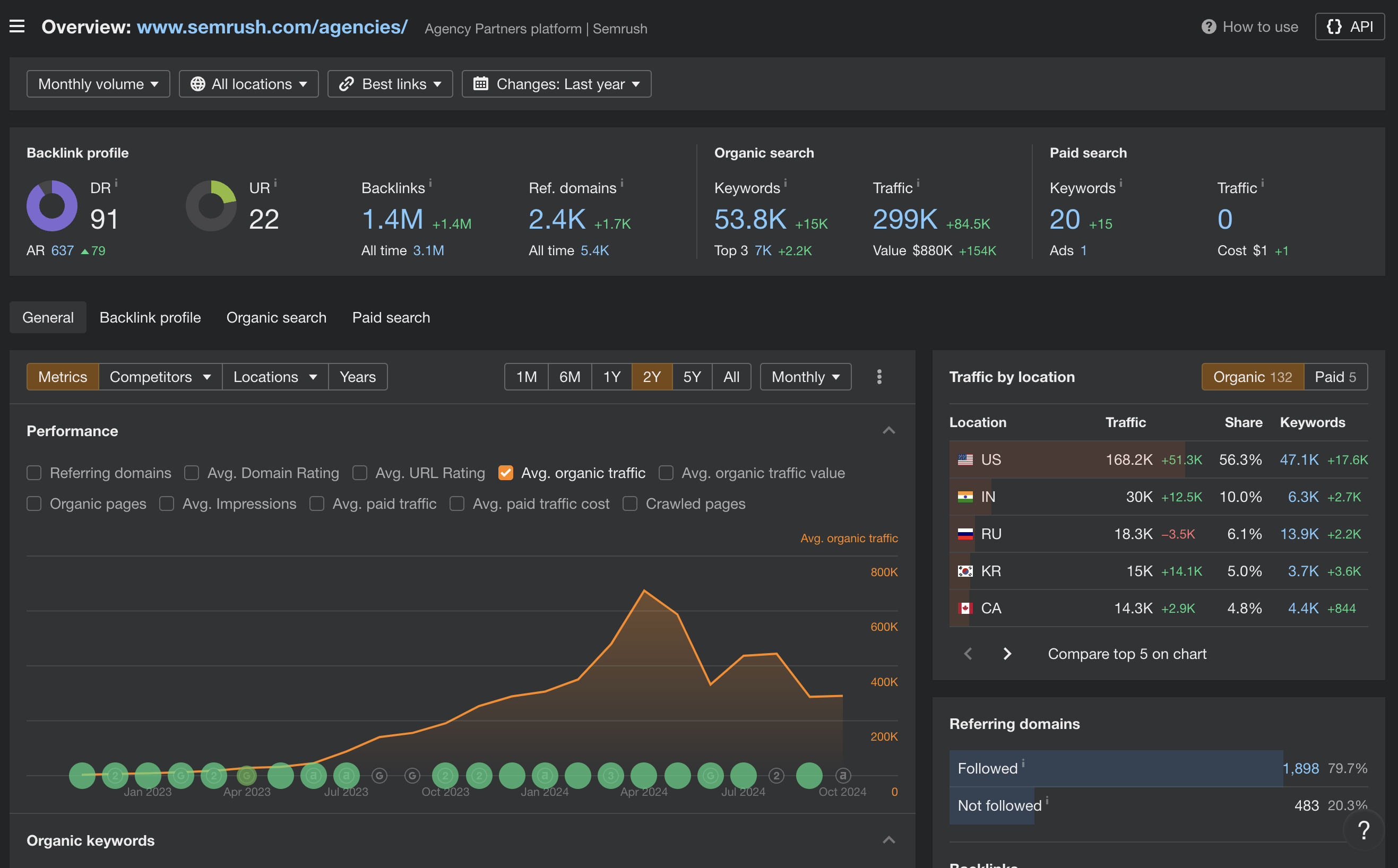

I guess this is one of the most successful SEO projects for Semrush team.

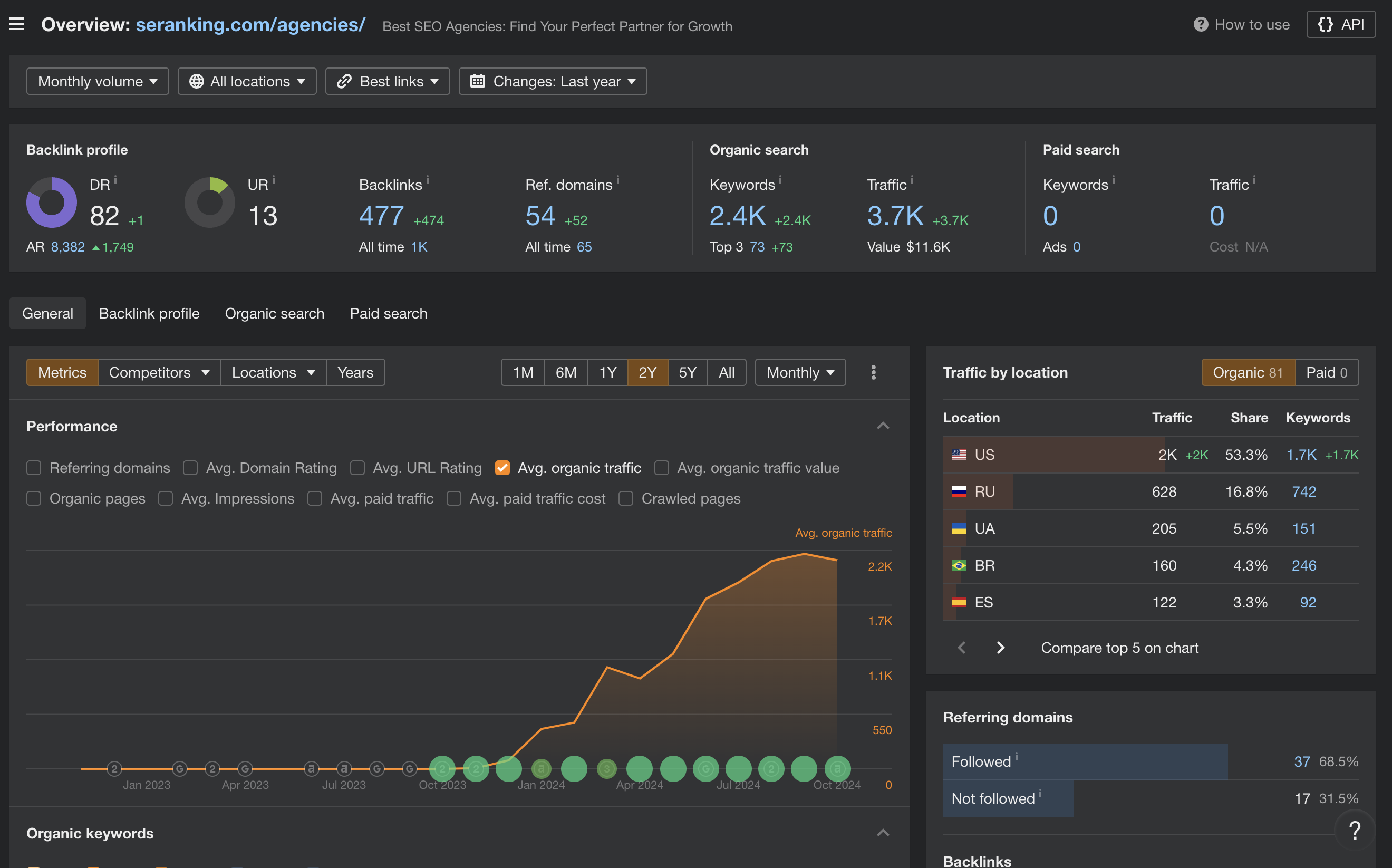

SE Ranking have launched such directory at the end of 2023.

They have modest results, but perhaps they are in no hurry to pour out many pages so as not to reduce the quality.

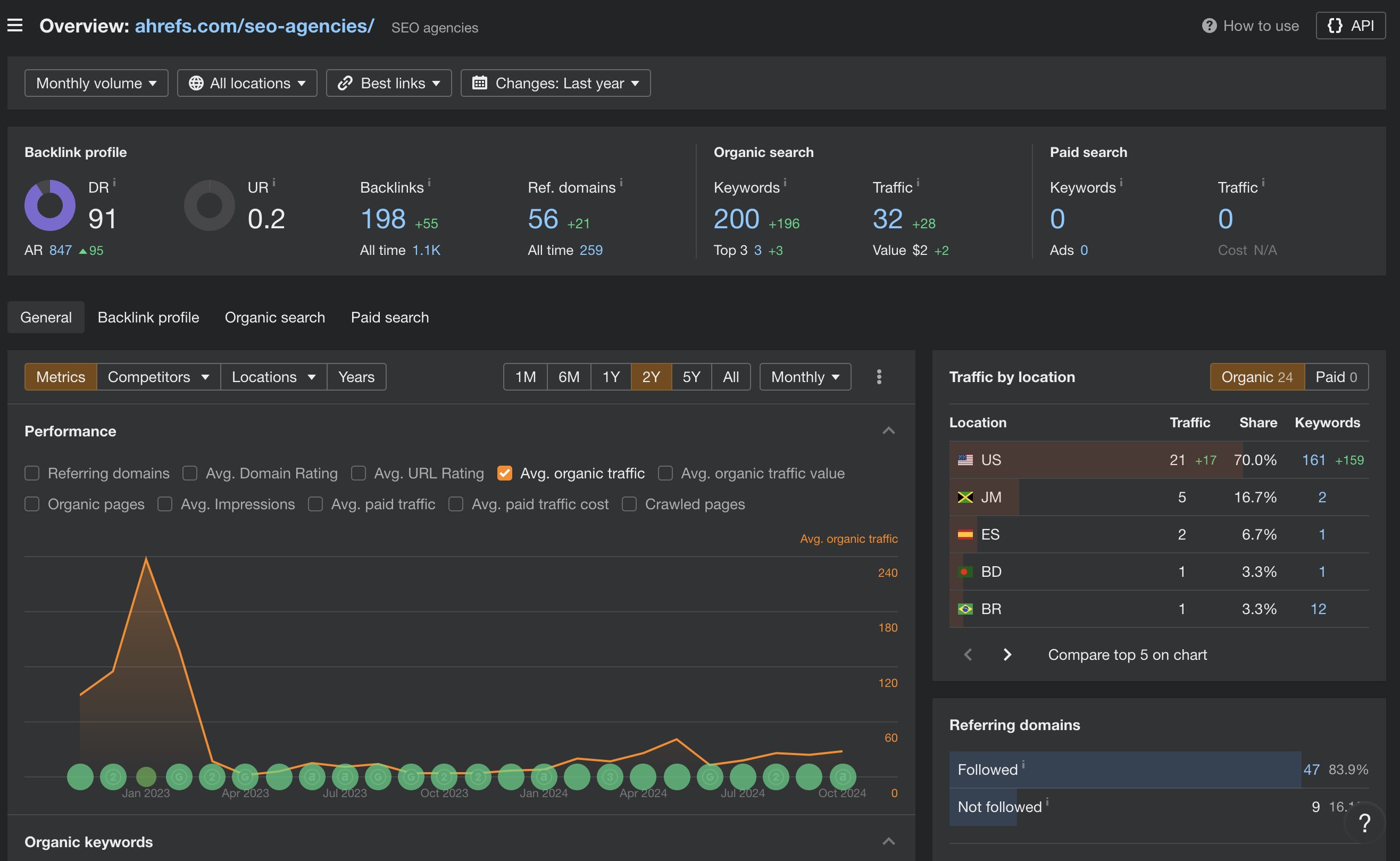

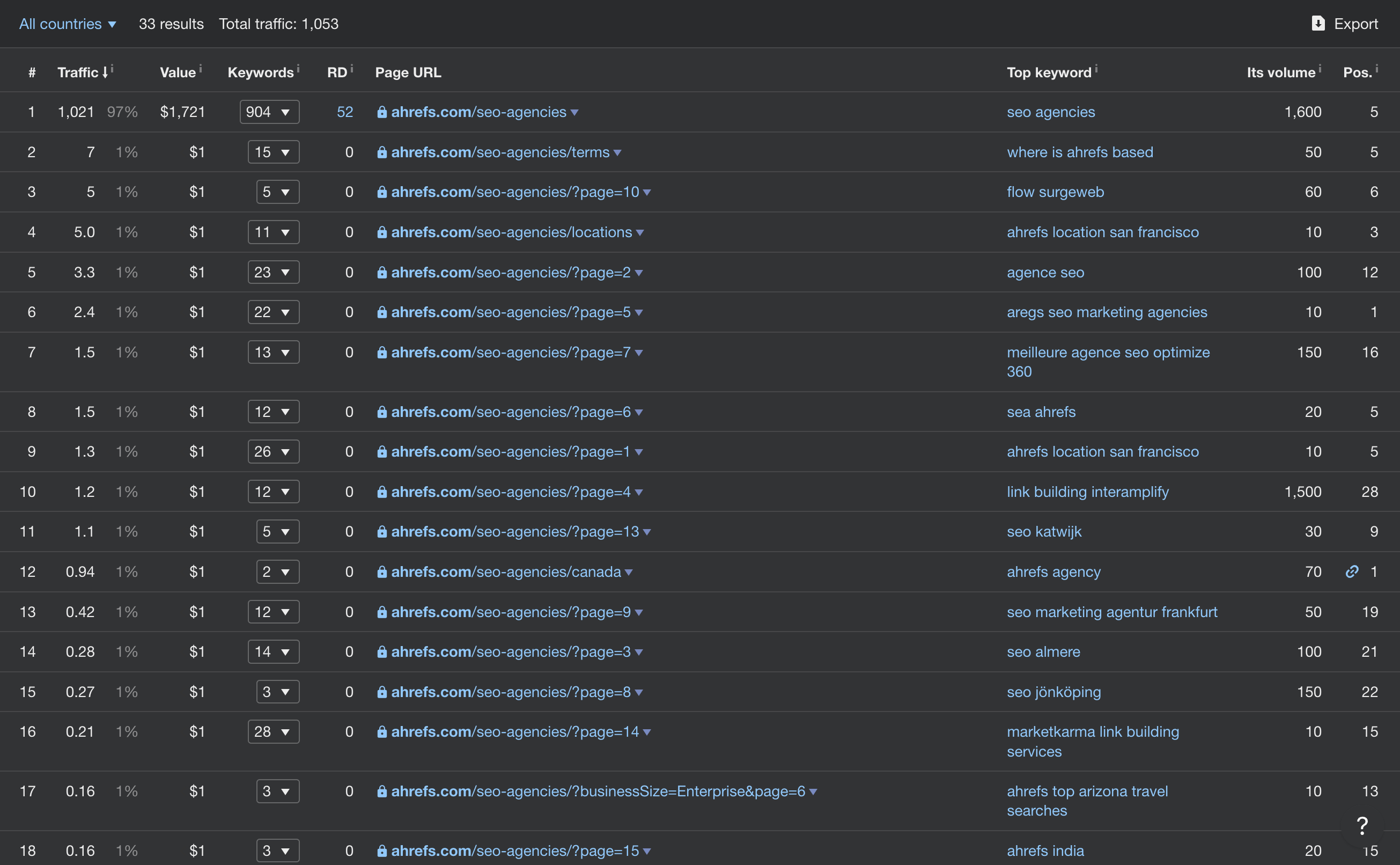

But with Ahrefs, it’s an interesting story.

In my opinion, this is their second big mistake, which consists of 2 parts at once:

1. They did not want to create a directory of SEO agencies and collect traffic for queries related to the category of services and cities.

They created only one page where they placed links to the agencies that use them.

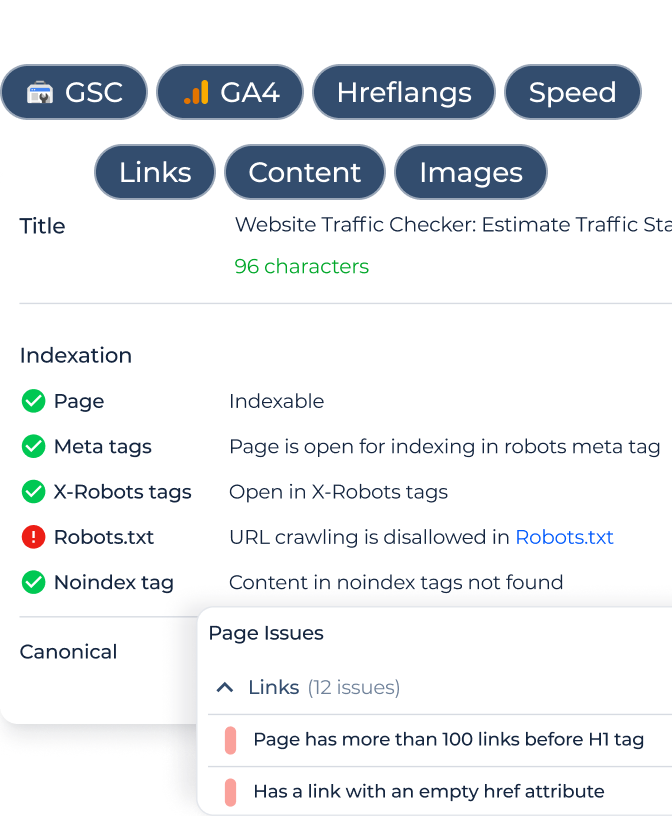

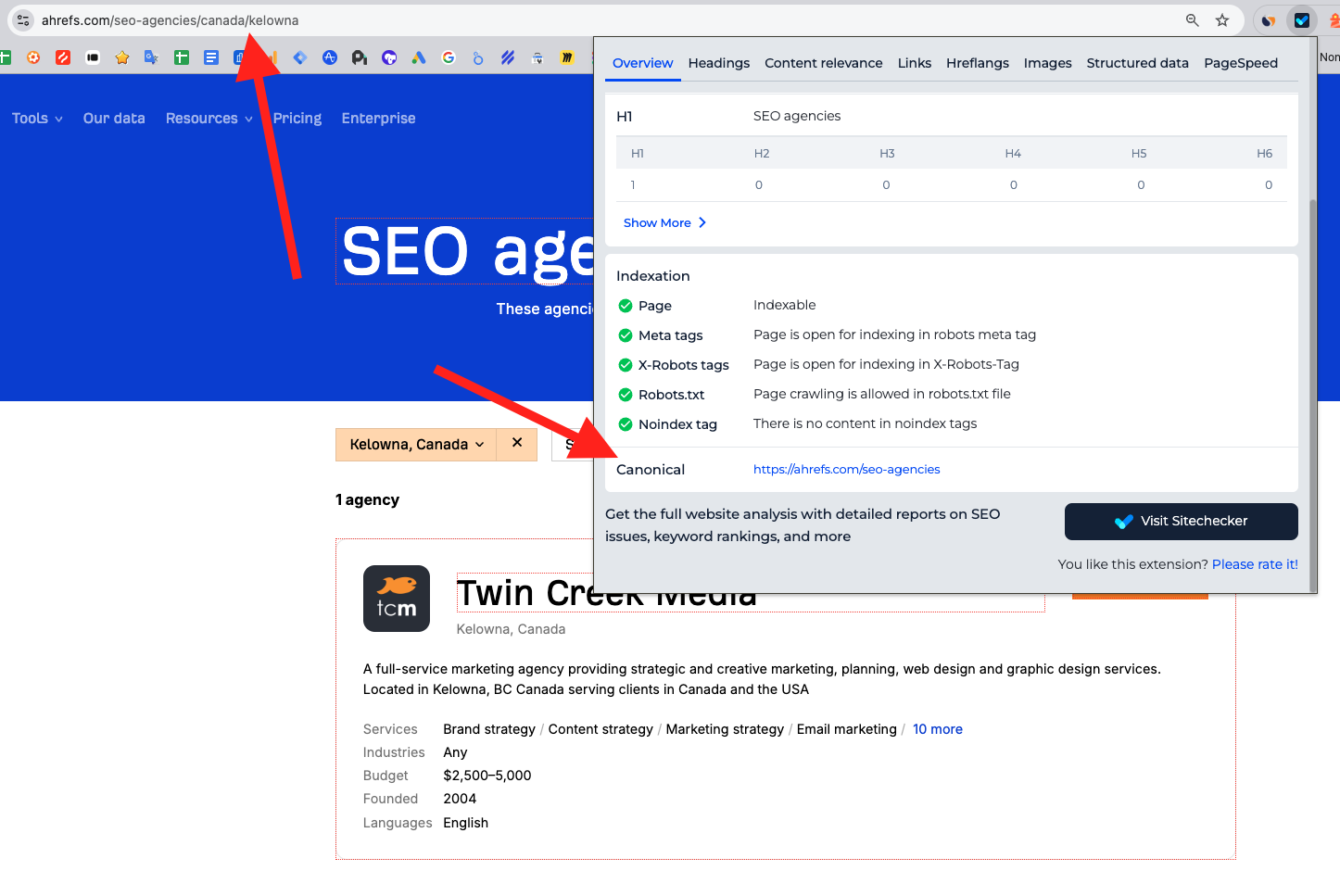

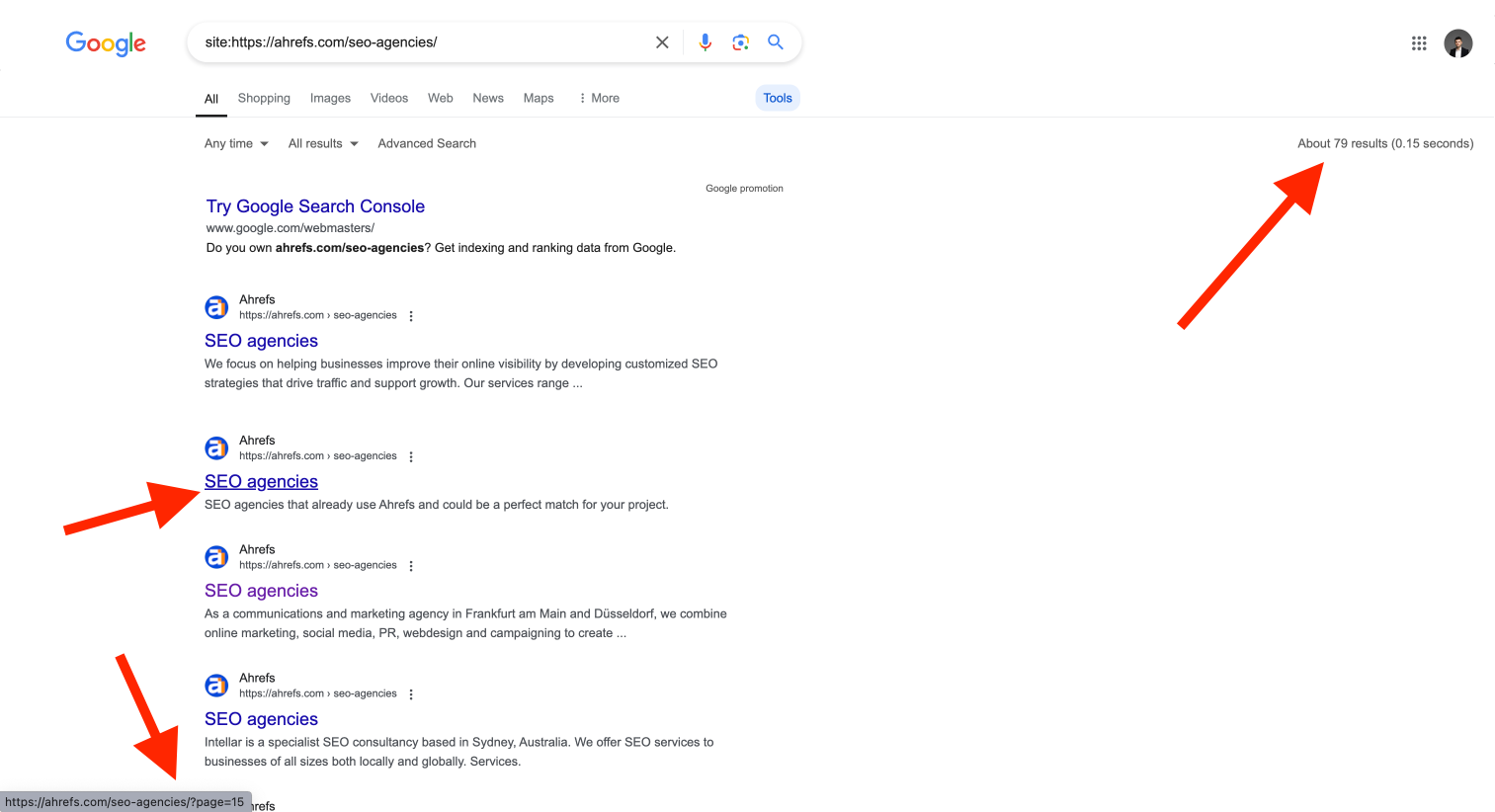

2. Nevertheless, they have separate pages for different locations, but they do not index them, and instead they use one canonical for the main page everywhere (this is a screenshot from the Sitechecker Chrome Exension)

This case is another reminder of how dangerous it is to use canonical instead of noindex.

Google has its own vision of what is valuable for users and it began to index pagination pages.

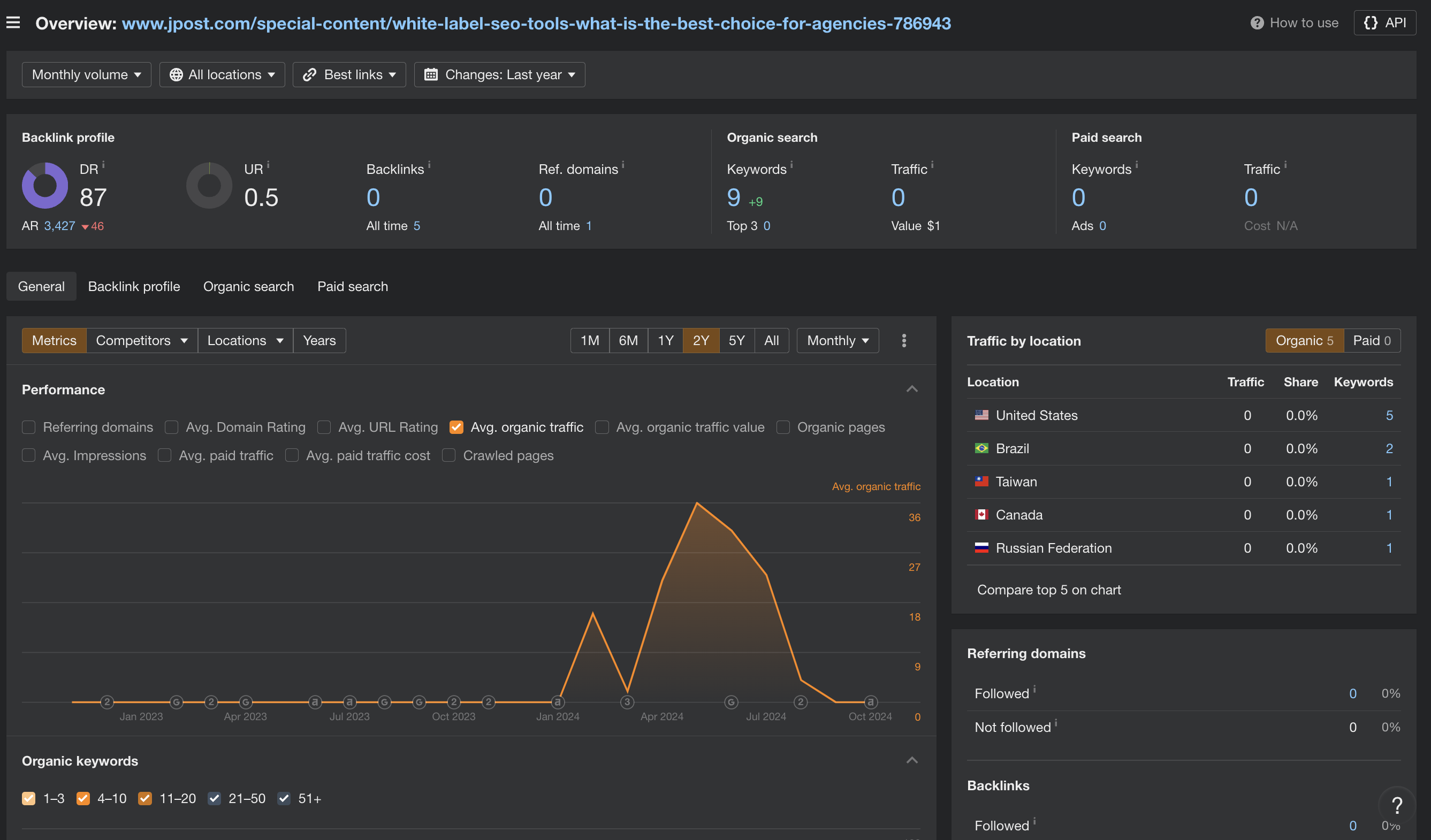

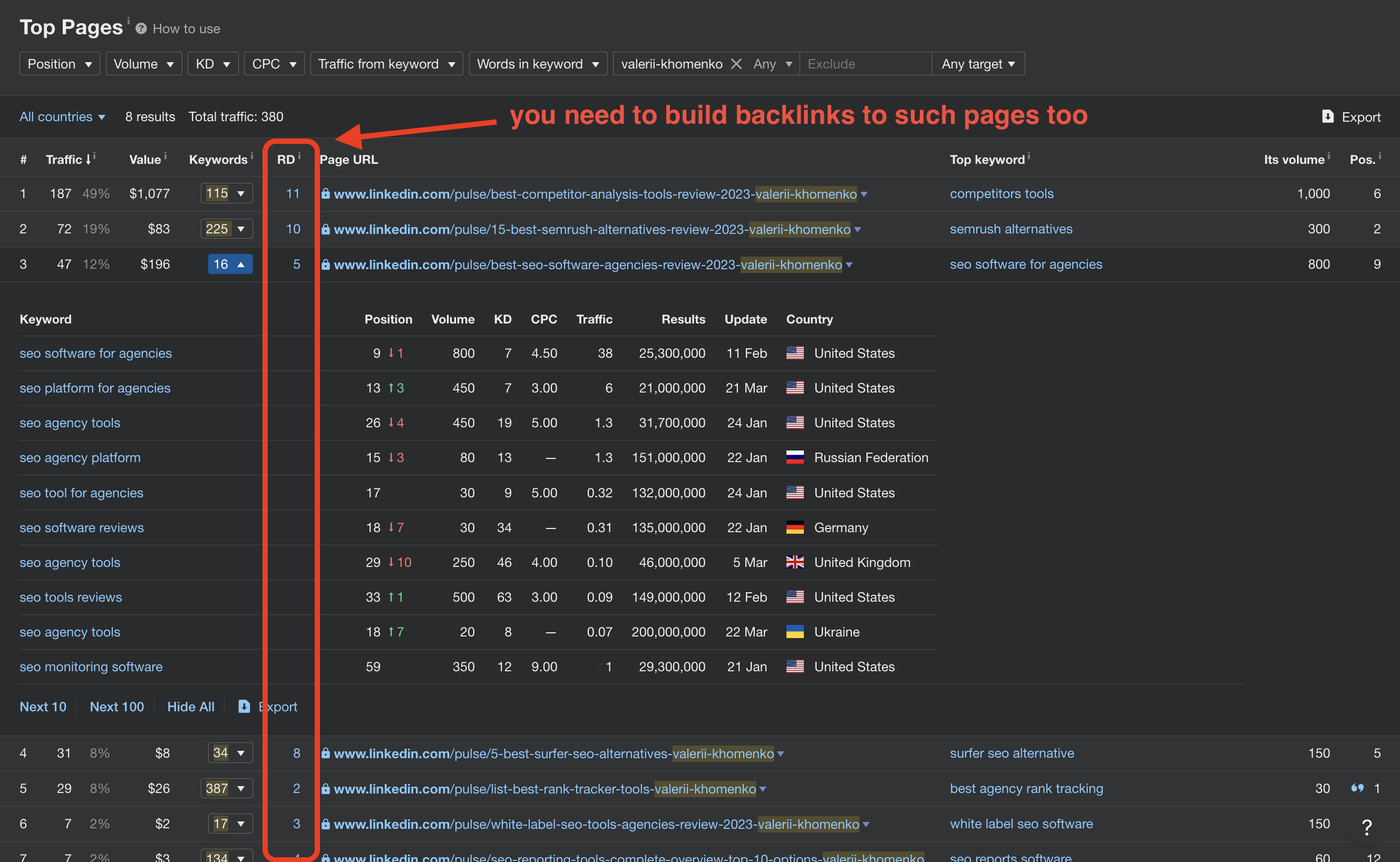

7. Parasite SEO

So far I have only noticed such experiments from SE Ranking.

The experiment with placing an article in the media ended with a bad result.

But the option with articles on LinkedIn works much better. Probably after the team saw the first successes, they decided to add backlinks to these pages and now they are ranked quite well.

I have also experimented with parasite SEO on LinkedIn, Medium and Reddit and have had good results.

I am sure that for small SEO brands with little authority of their own domain, this option of attracting traffic is a great opportunity.

8. Listicles “best SEO tools for {…}”

Most brands don’t do this for the following reasons:

- they already have product pages, and listicles can cannibalize these product pages;

- they don’t want to put backlinks to competitors;

- it’s easier to negotiate about adding a backlink to their product in listicles on other sites that are already ranked in the top 10.

However, Semrush and SE Ranking tried to do this.

The results are average, but this is a working option, since Google does not see a problem in the fact that the rating is compiled by one of its participants 🙂

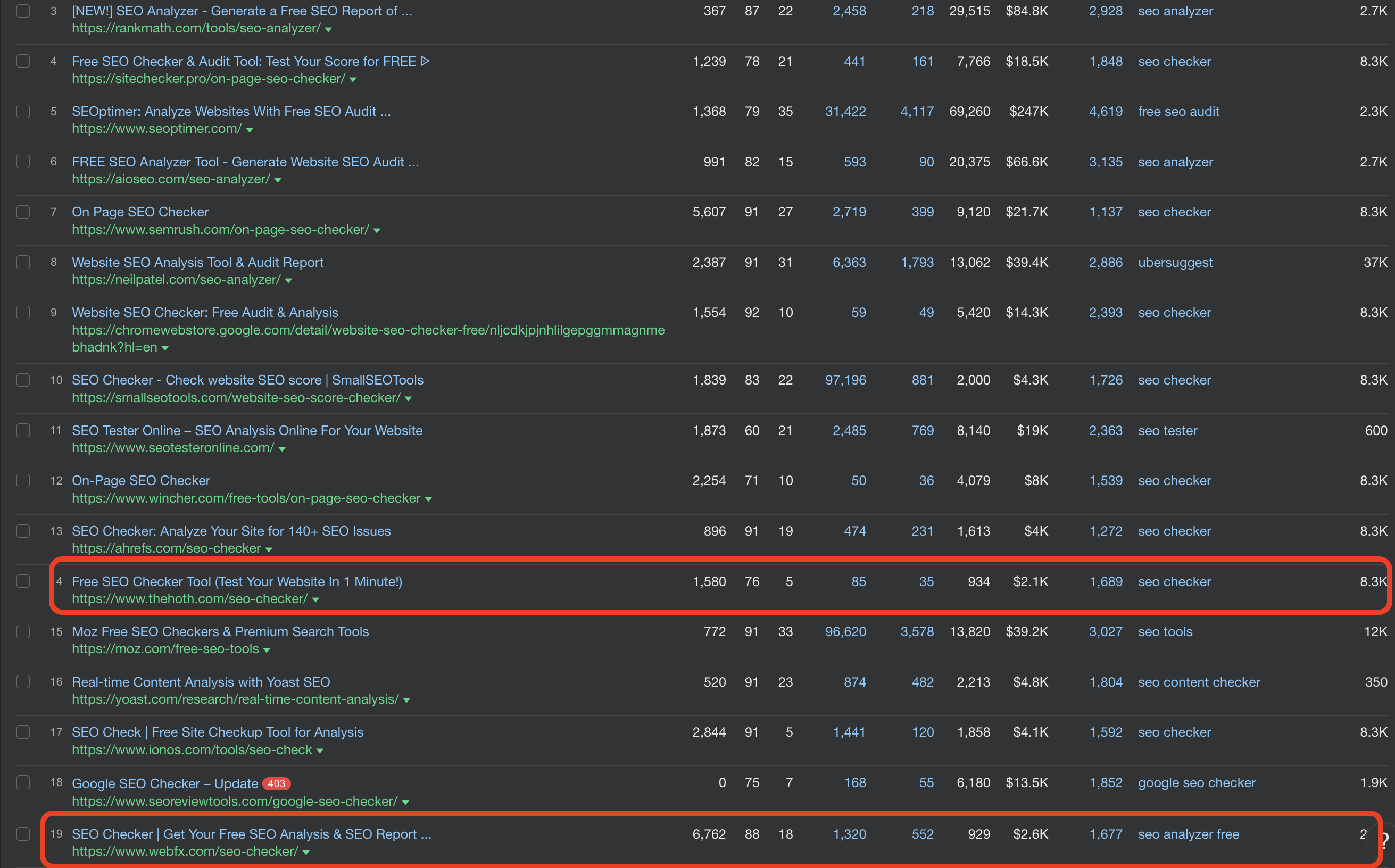

9. Agencies create and promote landing pages with their own tools

Here are some examples:

- https://www.highervisibility.com/seo/tools/seo-website-grader/;

- https://www.webfx.com/seo-checker/;

- https://www.thehoth.com/seo-checker/.

It is expected that agencies want to cover these search queries:

- many of their sites are already authoritative enough to rank for such competitive queries;

- such tools work as excellent lead generators for their services.

This is an additional source of increased competition.

10. Competition increased for the first places in listicles on websites that rank in top-10

This is just the conclusion of our outreach department, which has been working for several years to add us to all landing pages on other websites that rank well by queries like “best SEO tools for …”.

SEO brands are ready to pay more and more to be first in ratings and review pages that people find on Google Search.

Trends in pricing policy

Credits and pay as you go model

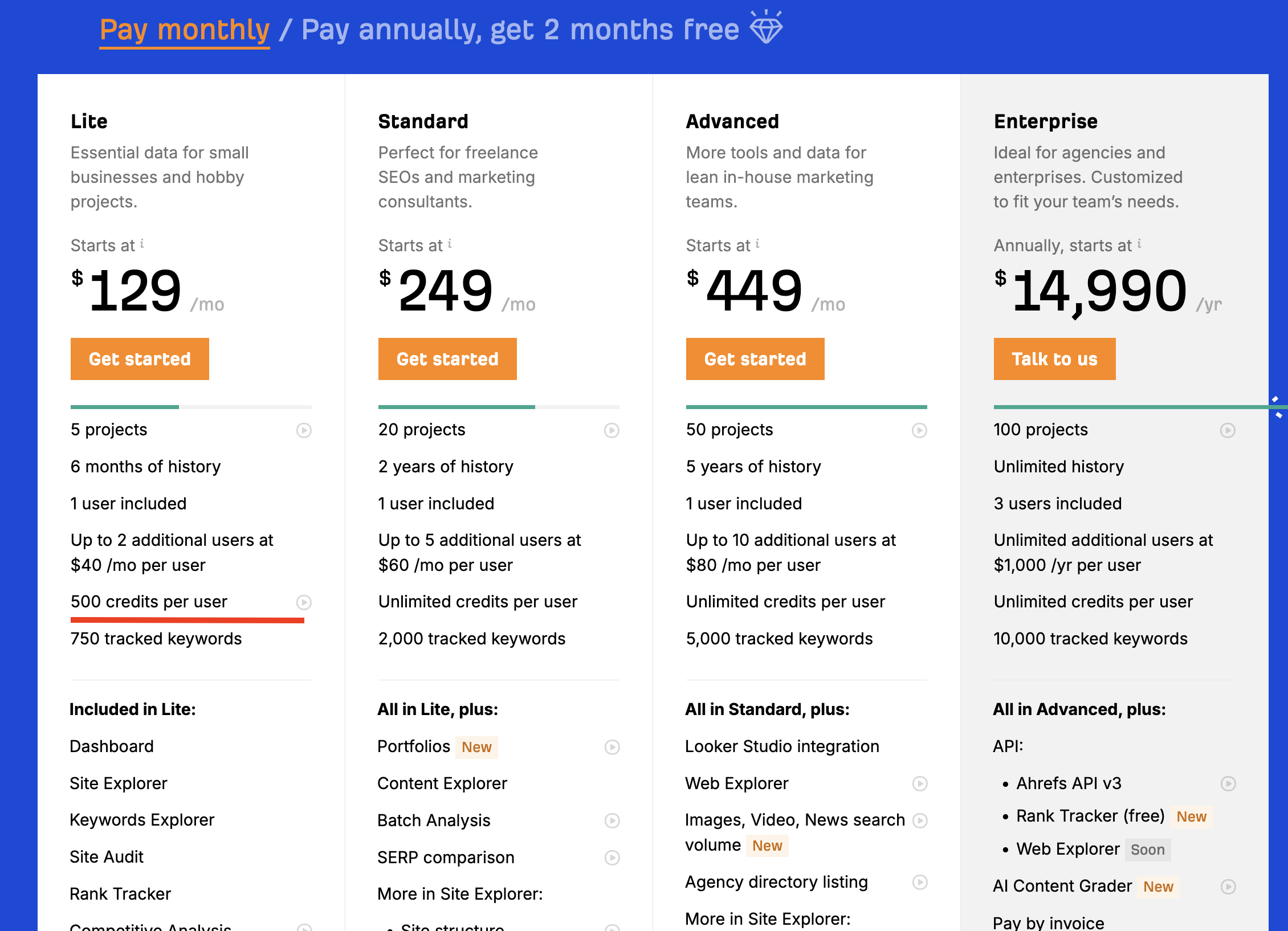

A year ago Ahrefs said they lost 25% of about 15% of legacy accounts (which are about 40% of their total paying customers) after releasing new subscription plans.

These plans contained credit logic, where you should pay for every action like downloading the report or exporting some files.

A few months ago they understood that this was a bad move and removed credit limits for all plans except the first one.

However, the idea of credits isn’t bad if implemented right. Credit policies fail when user expectations are not met.

In the case of Ahrefs:

- people could not predict what the final cost of using the product would be;

- such a policy significantly worsened the user experience, since any report or file download that was previously included in the subscription now cost a separate amount.

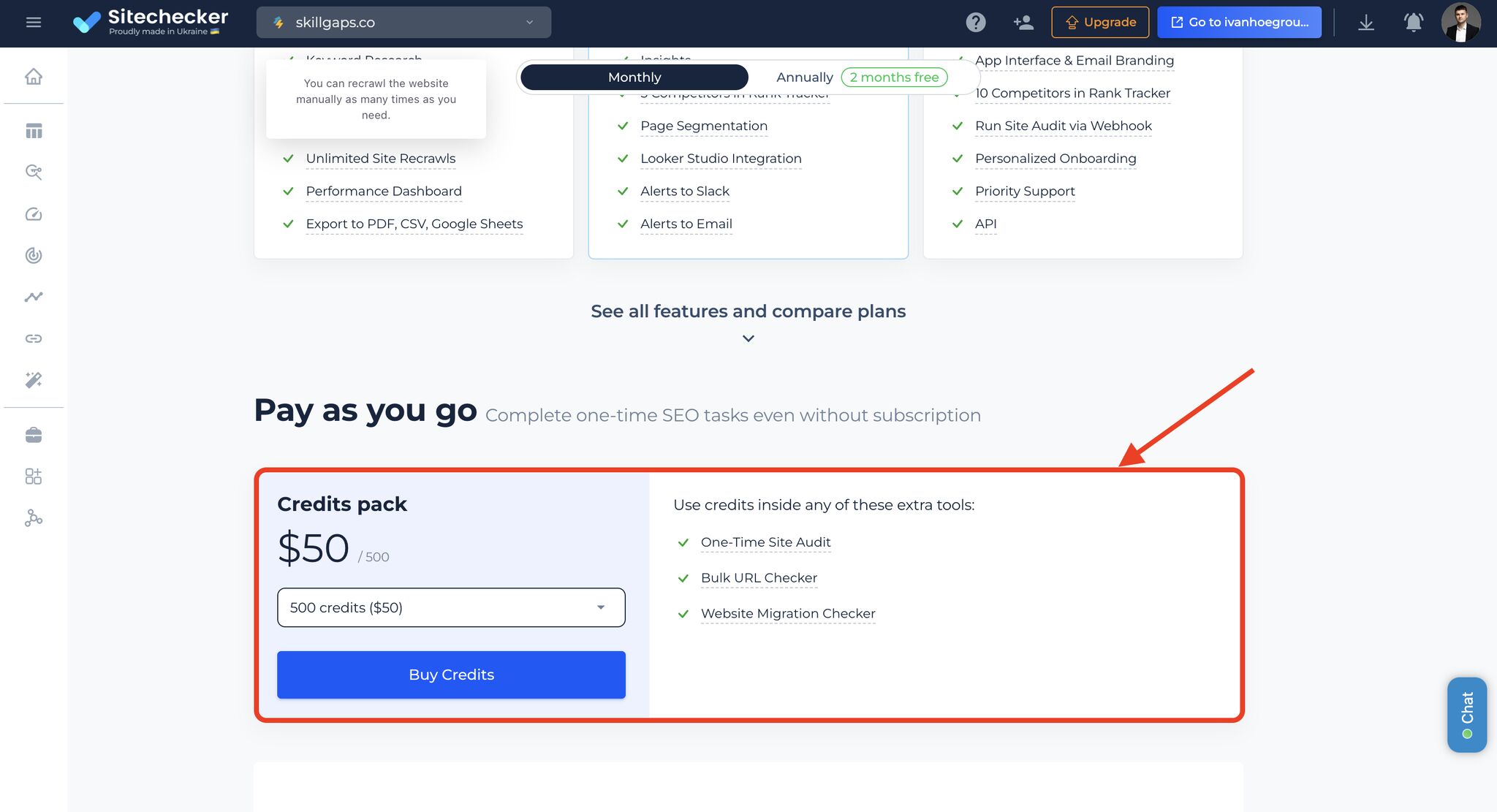

We added credits a few years ago to Sitechecker (earlier than Ahrefs) to increase flexibility for customers. And this works well!

- Some people don’t need a subscription, because they work on non-recurrent tasks.

- Some people need a subscription for one task and a pay-as-you-go model for another task.

Both types get a value from the pay-as-you-go model.

Another companies who use pay as yo go model: SE Ranking, KeywordInsights, SurferSEO.

I think we’ll see more pricing changes like this.

Companies are looking hard to optimize their marketing budgets. If you can offer a company to pay only when and for what they need, you can win some audience for your app.

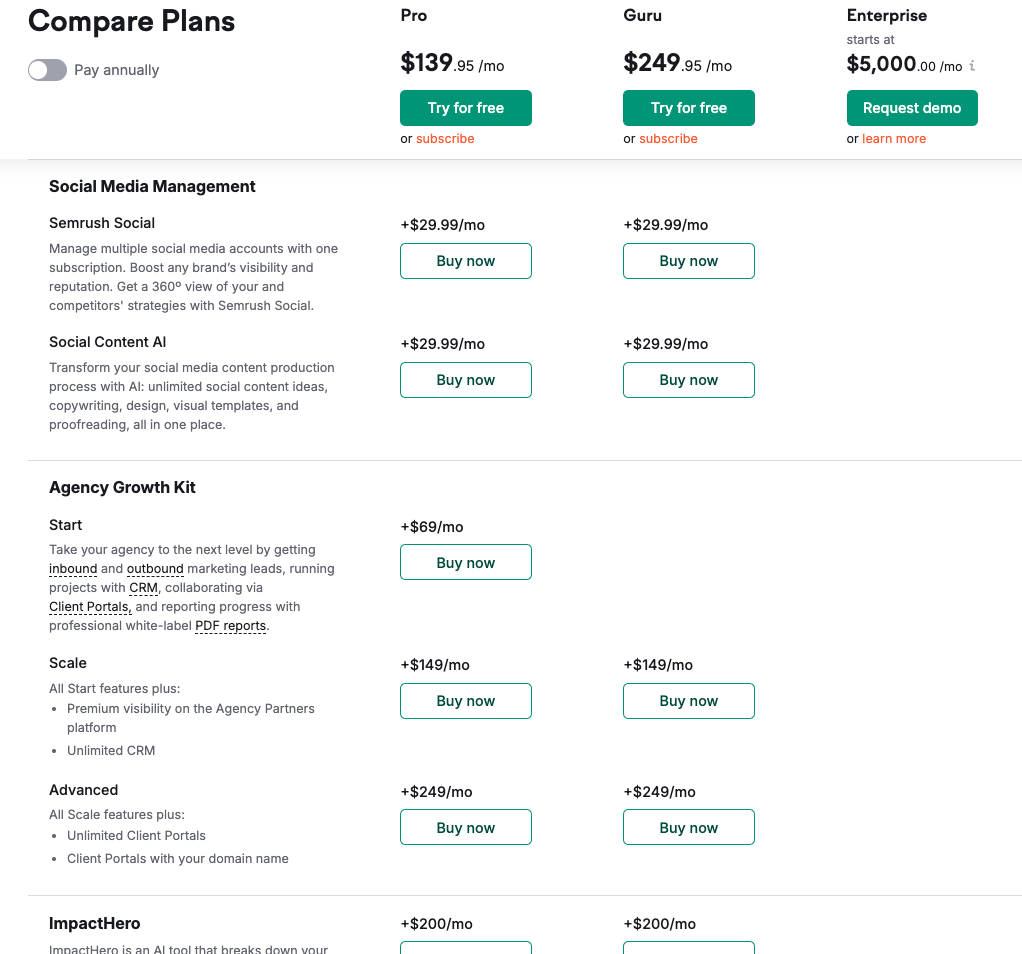

Add-ons

Add-ons are also increasingly becoming a standard in the pricing of market leaders.

Their value is that they do not shift the cost of a function to someone who does not need it, but allow the company to earn the maximum from its implementation from the audience that needs it.

Semrush, Ahrefs, SE Ranking already implemented them.

We’ve also planned to make our White Label feature available as add-on, but then decided to leave it in Premium plan. We will do it but later.

Charging for users

Charging for users is one of the key models of any SaaS business.

But it was not so common in the SEO software market and is still not so popular. Due to the fact that the value metric in such software is often not in users but in the number of sites, pages, keywords, and the like.

But the market leaders, who show their pricing (Semrush, Ahrefs, SE Ranking) have already implemented this. This had to happen, since their value is closely related to access to exclusive data.

The lack of payment for the number of users provides a huge lever for user abuse.

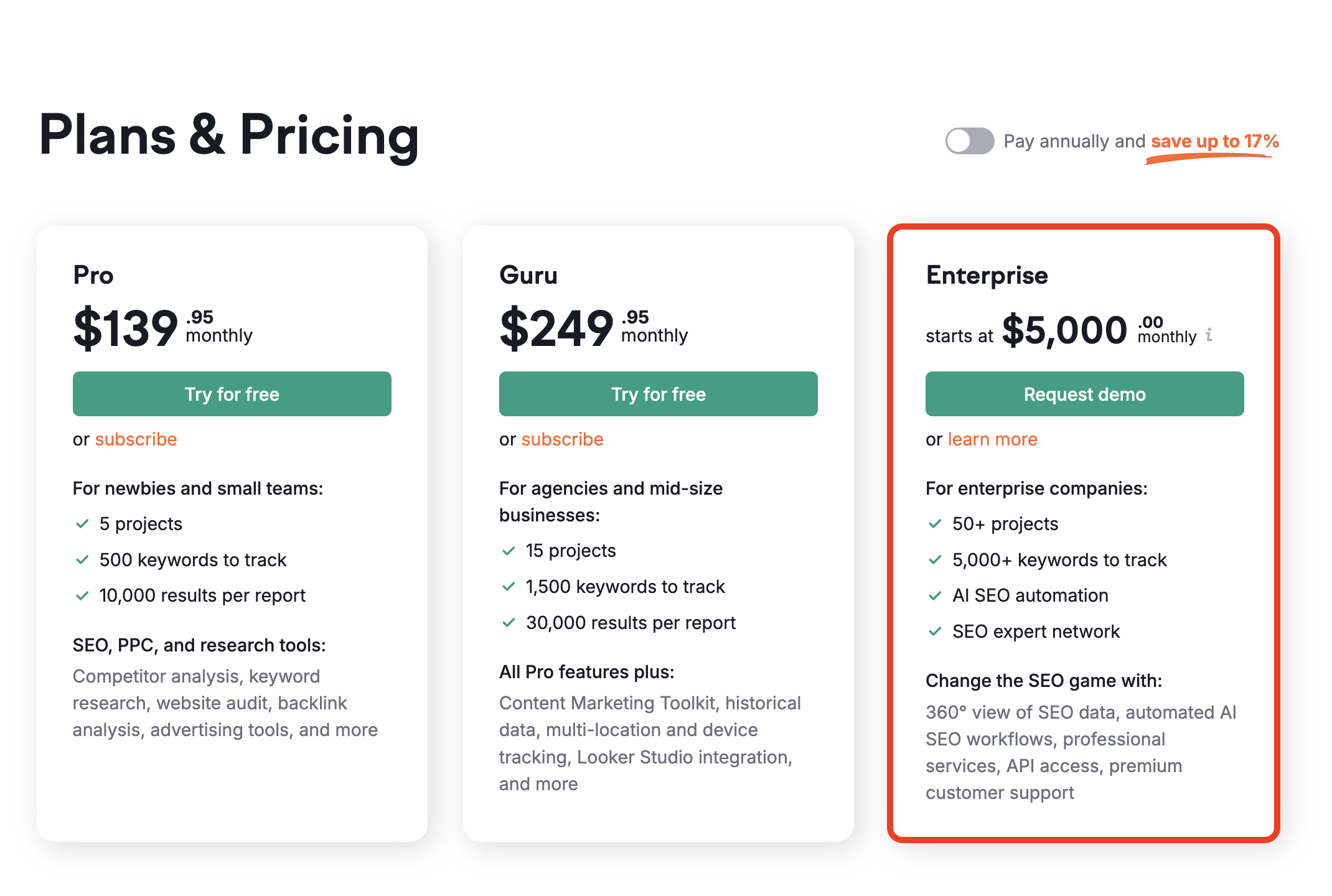

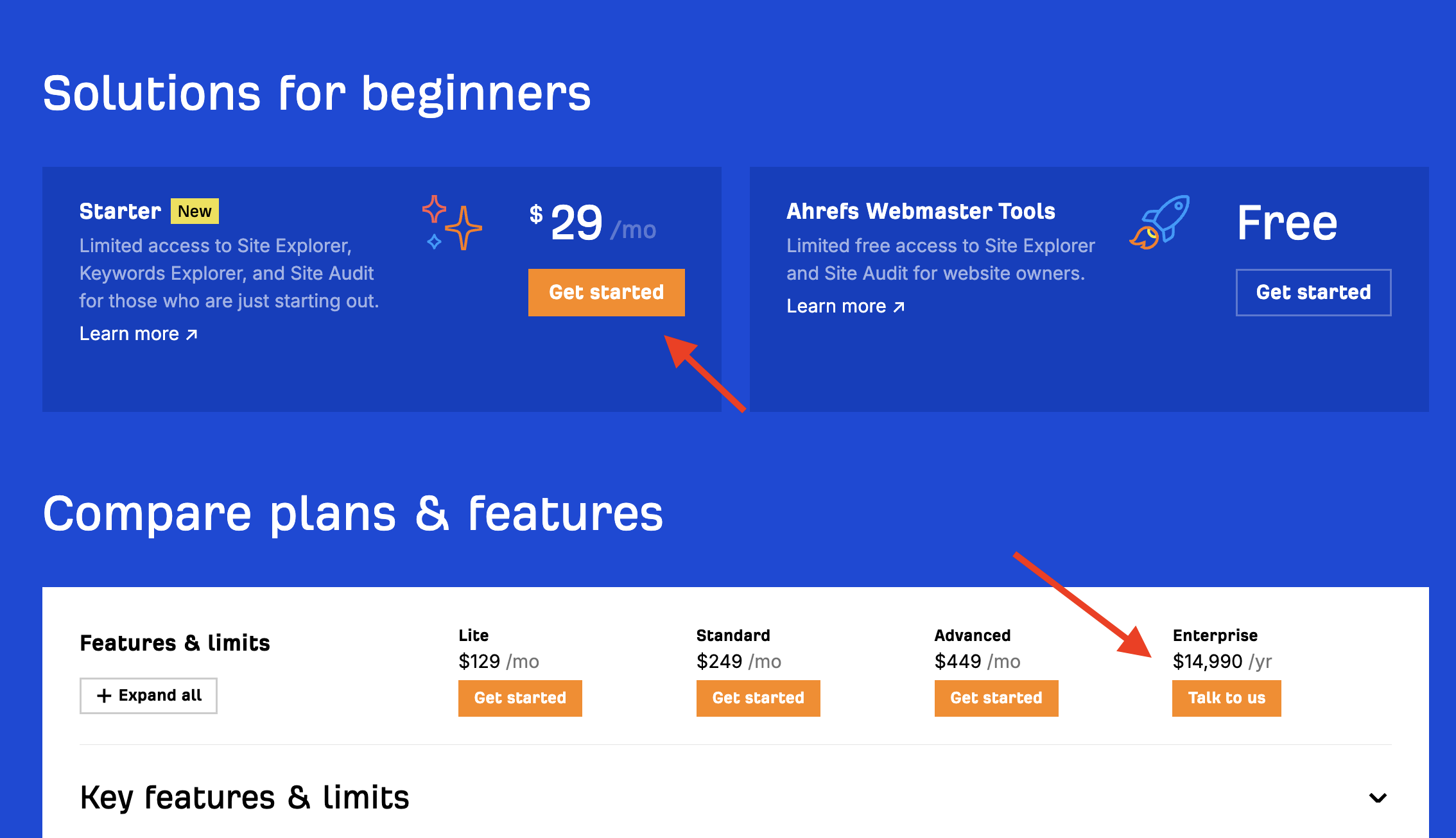

Leaders go upmarket and downmarket

Looks like Semrush goes upmarket and Ahrefs goes both upmarket and downmarket.

Semrush removed the Business plan ($499/m cost) for new users and added Enterprise ($5k/m) cost instead.

Ahrefs removed the option of monthly payment for its Enteprise plan and removed the option of paying for it without communicating with the sales department.

And also added a cheap plan for beginners costing $29.

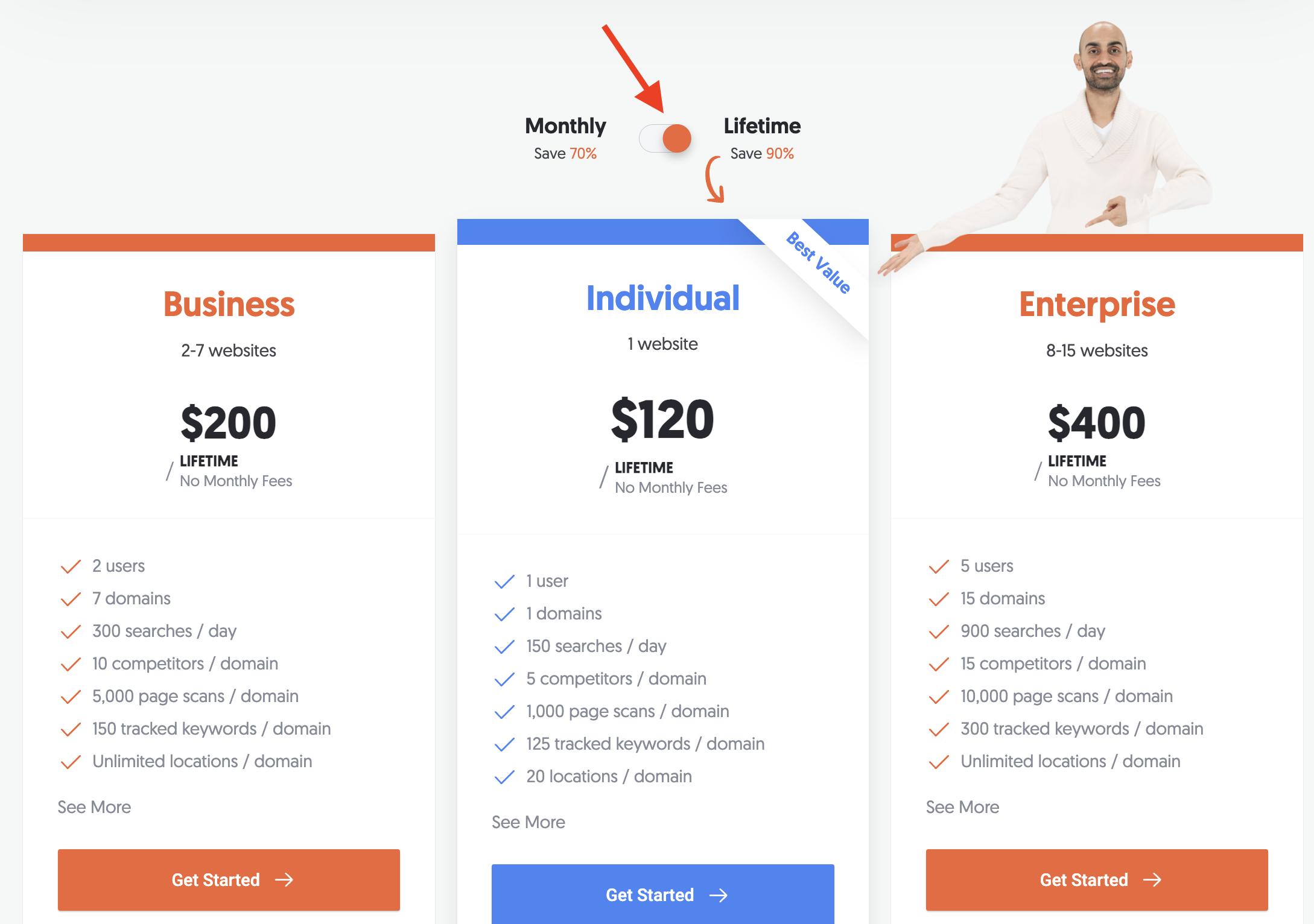

Lifetime packages

Neil Patel is the only one who uses a life time package in his tool UberSuggest.

This is quite an interesting case. With constant costs for monitoring keywords, pages and competitors, such a model will be profitable only if you have data that 80-90% of users will churn after 3-6-12 months.

I am sure that Neil has this data and he is very good with mathematics.

Interesting facts about some brands

These are just observations that caught my eye.

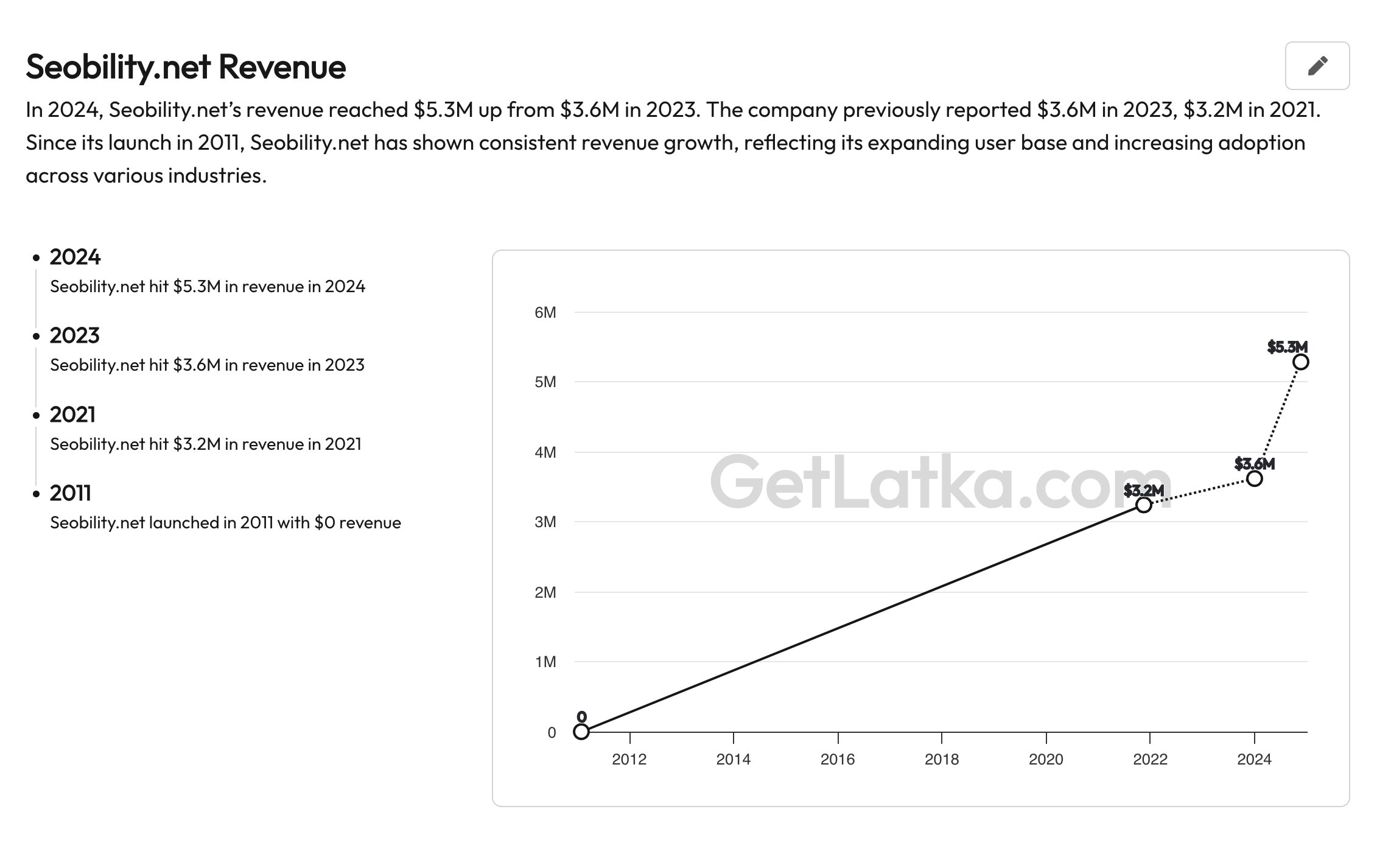

Seobility

Looks like in 2021 Seobility stopped growing in terms of money. Perhaps because of this, they decided to be acquired by saas.group in October 2022.

If Nathan Latka’s data is true, then this was a great decision.

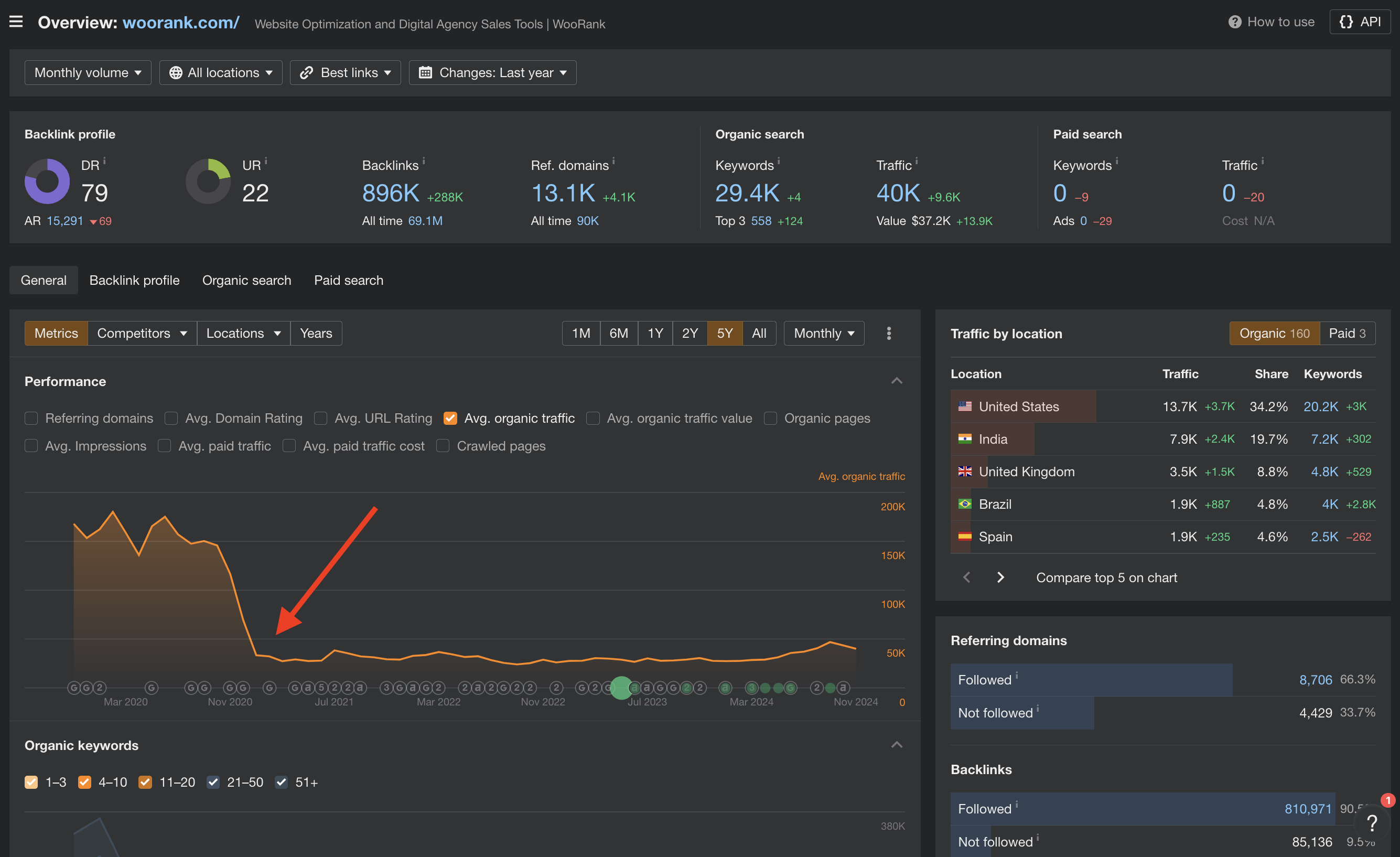

Woorank

It looks like November or December 2020 Google updates decreased Woorank‘s traffic 5 times from 250 thousand to 50 thousand users per month, and in February 2021 it was already acquired by Bridgeline Digital, Inc.

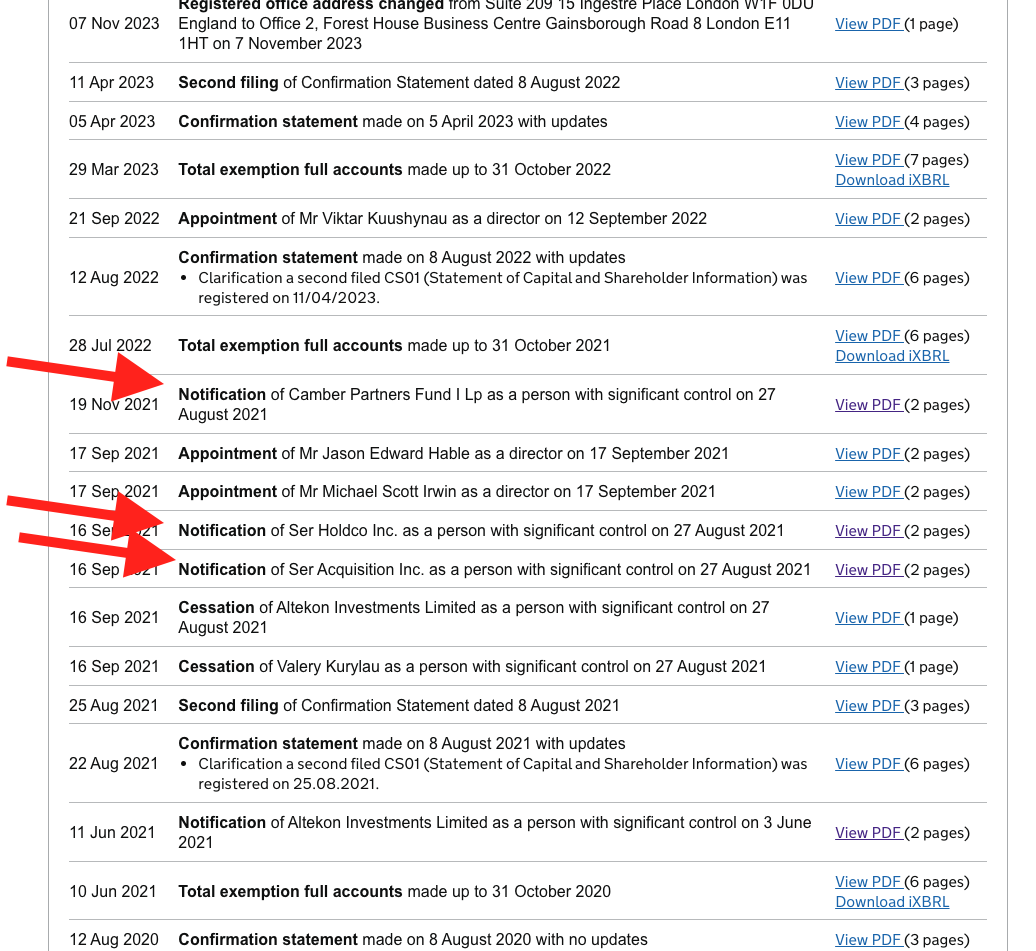

SE Ranking

In November 2021, Camber Partners Fund, which previously invested in PandaDoc and other software companies, invested into Seranking. After this, Head of Product from PandaDoc moved to the position of CEO at SE Ranking.

It has not disclosed terms of its deal with SE Ranking, but interview on TechCrunch gives some range of the investment sum.

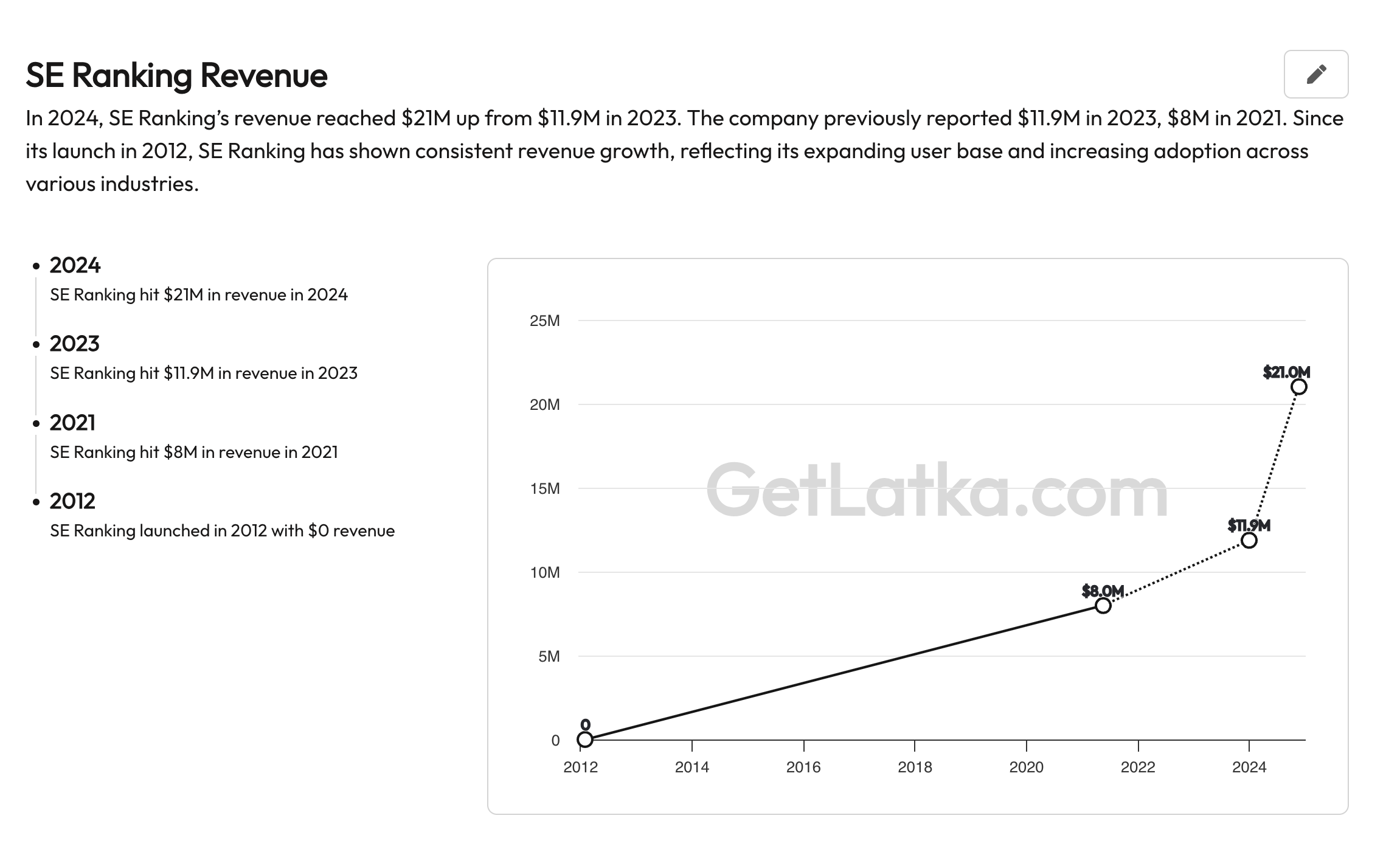

If it is true that they managed to grow x2 times in 1 year to $20mln annual revenue, then it looks like the investment was not wasted.

What’s is also interesting is that they changed their positioning with a focus only on agencies somewhere at the end of 2023.

This is an interesting decision, as we also decided to focus on positioning ourselves as the SEO platform for agencies around the same time.

Sitebulb

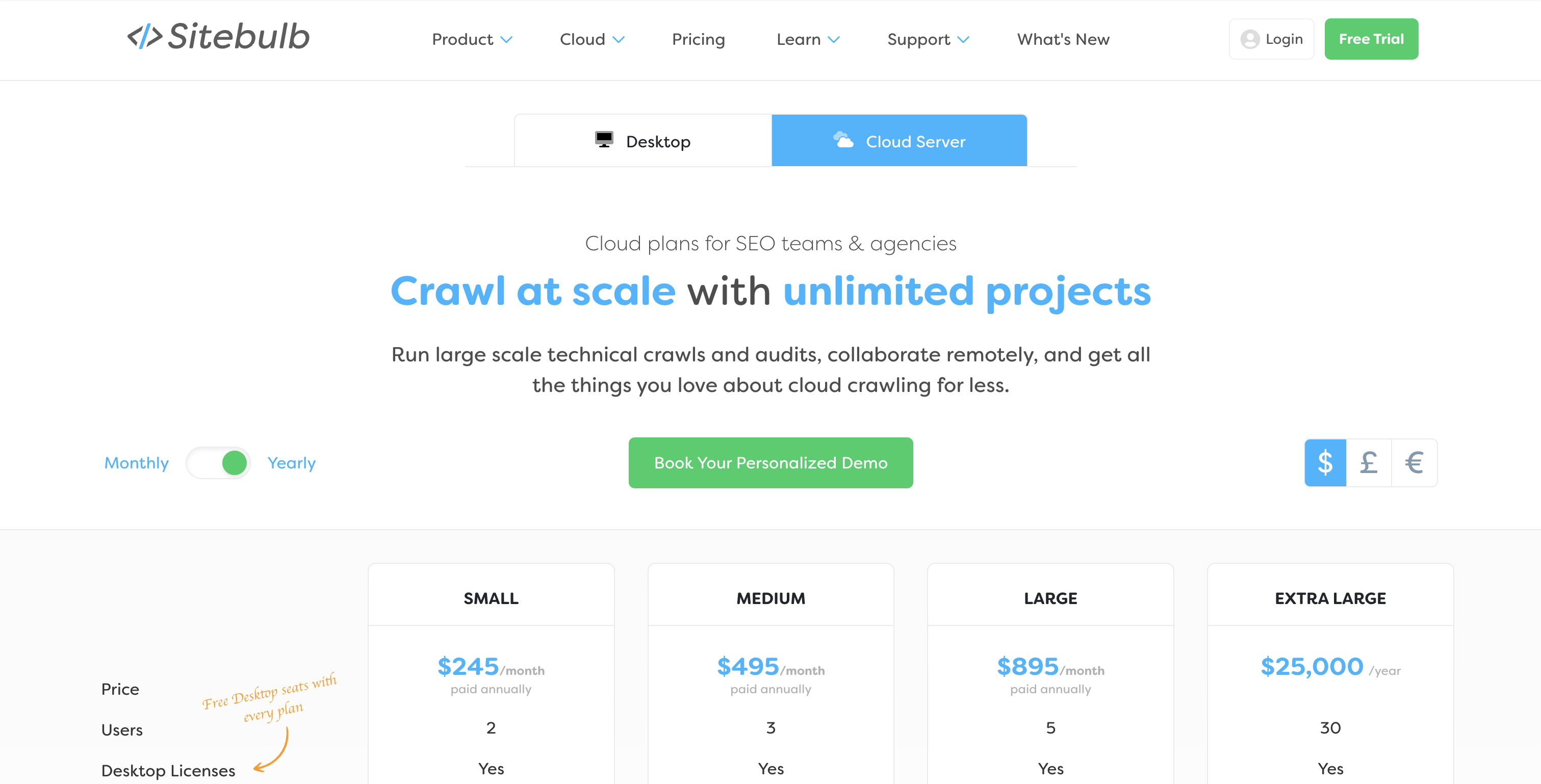

Sitebalb seems to have realized that there is no point in competing with Screaming Frog in the desktop crawl market and it is better to create a cheaper cloud alternative to Botify, Lumar and Jetoctopus.

You can learn from Sitebulb how he has designed his alternatives page so well and integrated them into the landing pages of the entire site.

He clearly understands who he is competing with and how he is better.

Accuranker

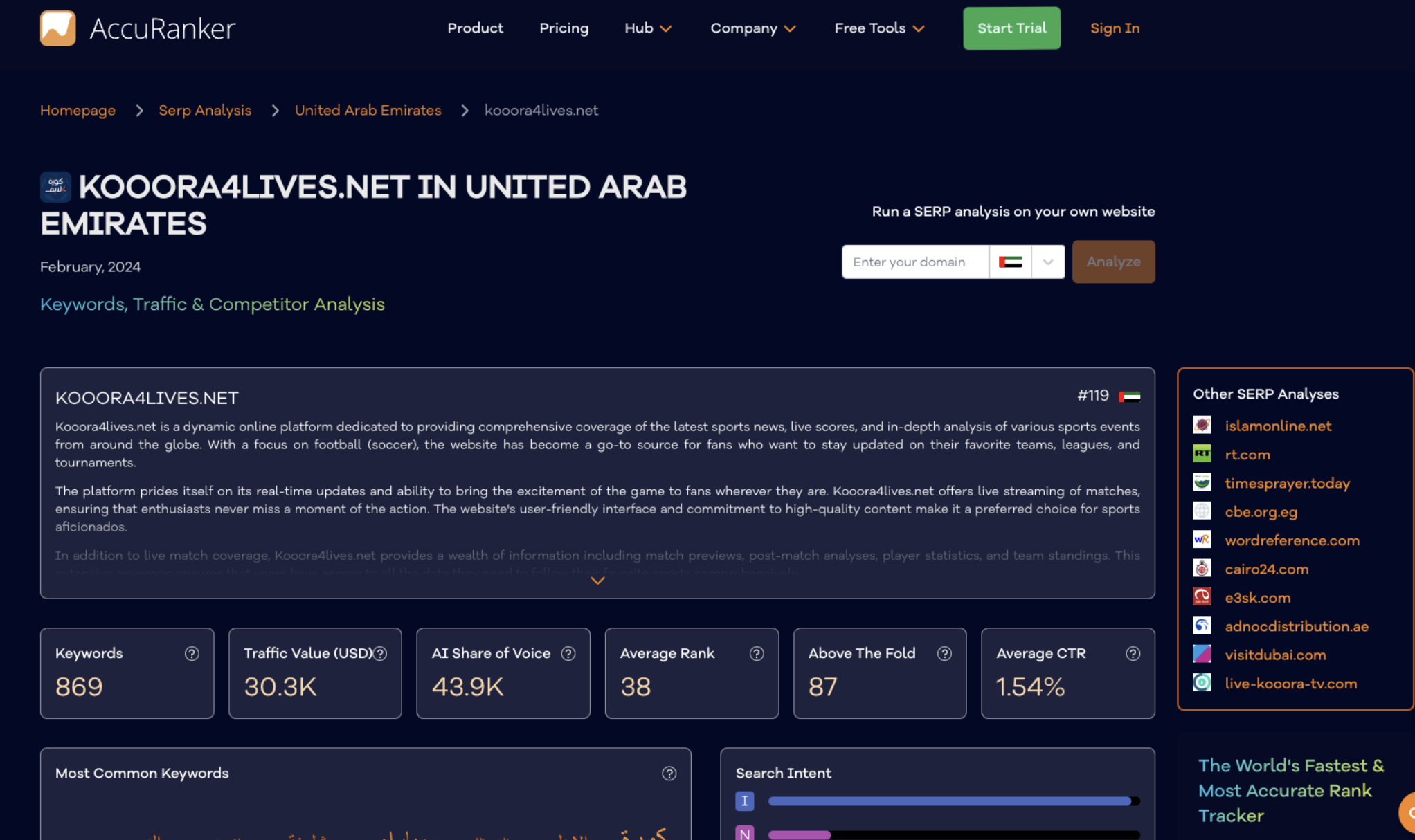

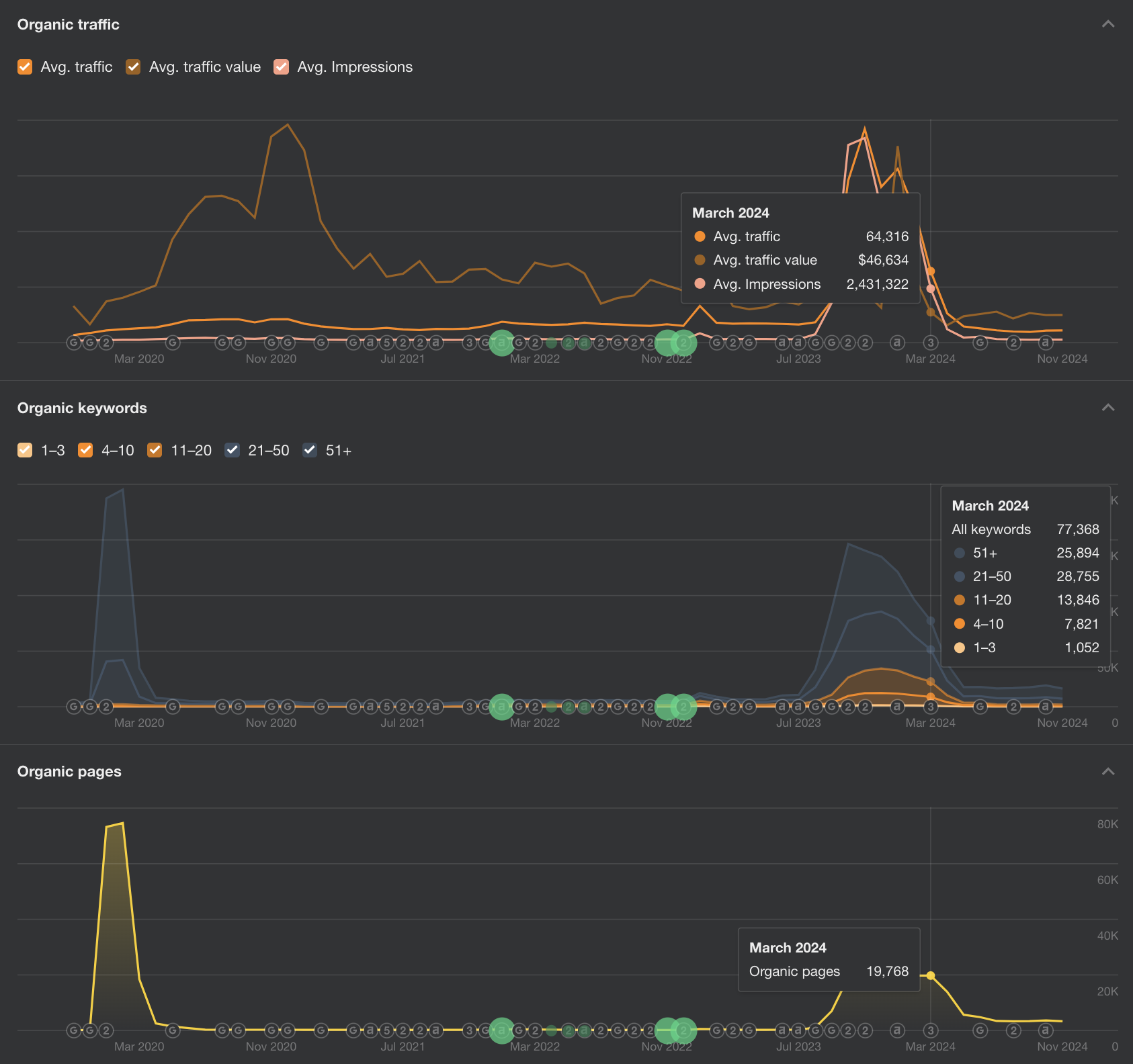

Vækst Partner Kapital acquired part of Accuranker a year ago. After acquisition, in September 2023, they began indexing SERP reports by websites’ brand keywords.

It looks like that in March 2024 they found that this tactic doesn’t work for them and decided to delete all such reports from index.

SurferSEO

SurferSEO is the most successful products in terms of growth rate! $20mln annual revenue in 6 years.

I looked for information how they did marketing in the beginning and then found this interview with Lusjan Suski.

Ahrefs

There are a lot of interesting things going on at Ahrefs. But I want to highlight the experiment with trying to launch a community on Circle instead of Facebook.

This attempt failed. This is a good lesson for everyone who work on SaaS.

- If you have gathered an audience in one place, you are unlikely to be able to move it to another place. Therefore, choosing a platform for a community is a very strategic decision that can rarely be replayed.

- It seems that the best communities are created on platforms or sites that people already visit, even if they are not in your community. A separate Slack channel, or a separate site for a community is almost always a bad idea.

Conclusion and forecast

In summary, I see the following key changes on the SEO software market:

For small and medium players

- They narrow their positioning either at the product level (what exactly they do) or audience level (for whom) in order to better compete with market leaders;

- For many, traffic growth and product development are frozen or very slow;

- Many are likely to be sold or acquired by market leaders this year and next (I said it in March 2024, but it is still the truth for 2025 too :)).

For big players

- Within their sites, they switch to low-conversion, but high search volume traffic, since they have probably exhausted the growth opportunities for the most valuable search queries.

- Increasingly, the focus is shifting to working with existing audiences, by adding new paid add-ons, trying to ride the wave of AI opportunities, and running their own offline conferences.

- They look for and realize growth opportunities by acquiring other sites in the SEO niche.